Thinking about gifting a car to a loved one, perhaps a family member or a close friend? It’s a wonderfully generous gesture, often filled with excitement and gratitude. Whether it’s for a new driver, someone in need of reliable transportation, or simply passing on a cherished vehicle, the act of giving a car is significant. However, even when no money changes hands, there are still important legal and administrative steps to consider to ensure a smooth transfer of ownership.

While it might seem counterintuitive to use a “bill of sale” for something that’s a gift, a properly drafted document serves as crucial proof of the transaction. This isn’t about collecting payment; it’s about establishing a clear paper trail for legal, tax, and registration purposes. Having the right documentation on hand can save you countless headaches down the line, from avoiding potential sales tax issues to ensuring the new owner can register the vehicle without a hitch.

Why a Gifted Car Needs a “Bill of Sale” (or Equivalent)

When a car changes hands, regardless of whether it’s a sale or a gift, governmental bodies like the Department of Motor Vehicles (DMV) or equivalent state agencies need official documentation to update ownership records. Without a formal document, proving that the vehicle was transferred as a gift, and not a cash transaction, can become incredibly difficult. This can lead to complications such as the recipient being liable for sales tax on a vehicle they received for free, or even issues arising from potential liability if the original owner is still on record.

A document outlining the gift acts as a clear statement from both parties that the car was transferred without monetary exchange, satisfying the need for transparency in vehicle title transfers. This prevents any misunderstandings or disputes regarding ownership and liability in the future. It’s also vital for the donor to clearly relinquish their interest in the vehicle, protecting them from any incidents that might occur once the car is in the recipient’s possession.

Key Elements to Include in Your Gifted Car Document

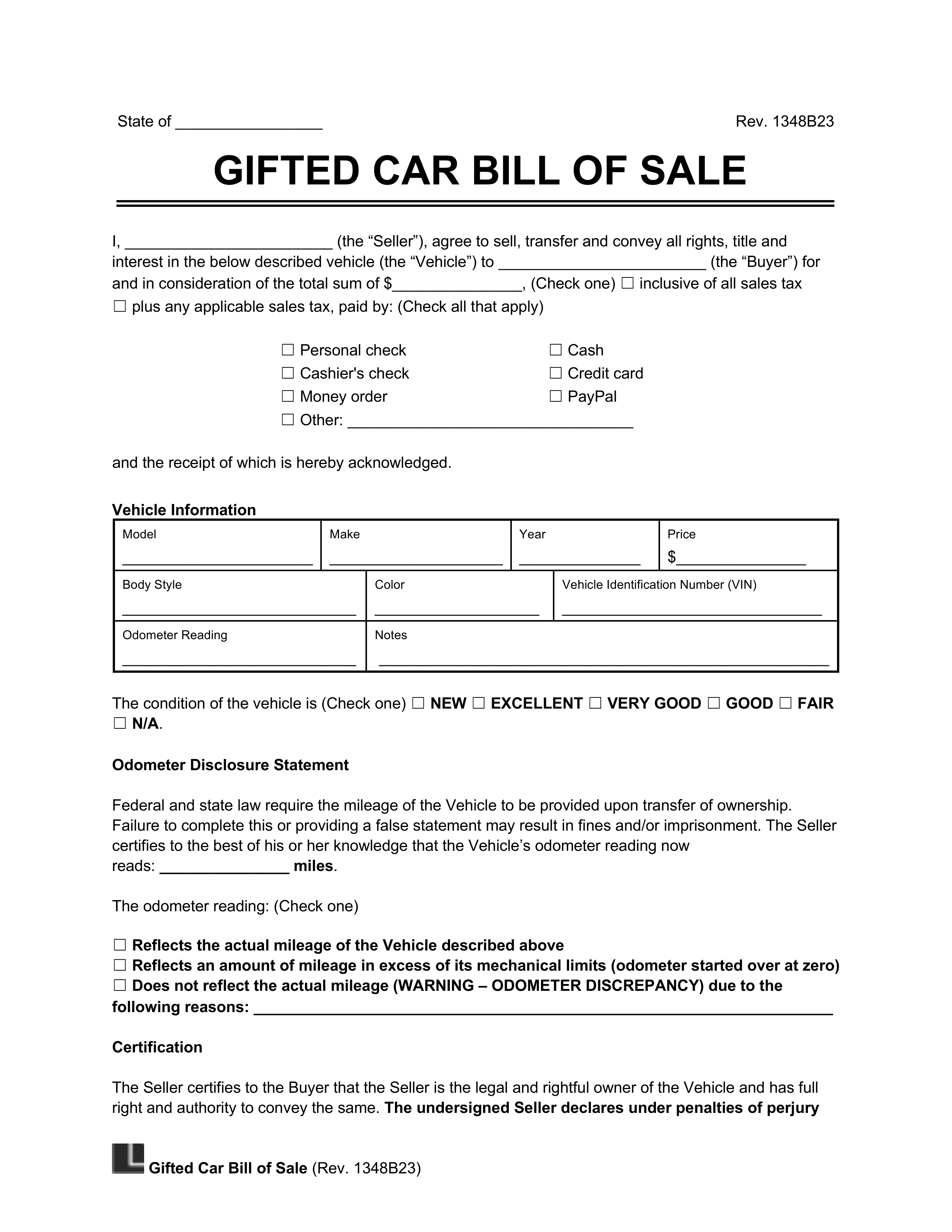

Creating a comprehensive document for a gifted car requires attention to detail. It’s more than just a handwritten note; it needs specific information to be legally sound and acceptable by state authorities. Think of it as a formal declaration of gifting, rather than a traditional sales receipt.

First and foremost, the document must clearly identify both the donor (the person giving the car) and the recipient (the person receiving the car). This includes their full legal names and current addresses. This establishes who is transferring ownership and to whom.

Next, detailed information about the vehicle itself is critical. This includes the make, model, year, vehicle identification number (VIN), and current odometer reading. These details ensure that the specific vehicle being gifted is unequivocally identified, preventing any confusion with other vehicles.

Crucially, the document must explicitly state that the vehicle is being transferred as a gift, meaning “no monetary consideration” or “zero dollars” were exchanged. This is the defining characteristic that differentiates it from a standard bill of sale and helps in navigating sales tax exemptions often applicable to gifted vehicles. Finally, signatures from both the donor and recipient, along with the date of transfer, are essential to validate the agreement. In many cases, it’s highly recommended to have these signatures notarized to add an extra layer of legal validity.

Here’s a breakdown of what your “bill of sale for gifted car template” should generally include:

- Full legal name and address of the donor (gifter).

- Full legal name and address of the recipient (giftee).

- Complete vehicle description: Year, Make, Model, Body Style, Color.

- Vehicle Identification Number (VIN).

- Current odometer reading.

- Date of the gift transfer.

- A clear statement indicating the vehicle is a gift with “zero monetary consideration” or “no money exchanged.”

- Signatures of both the donor and the recipient.

- Space for a notary public’s seal and signature (highly recommended for legal validity).

Navigating the DMV and Tax Implications of a Gifted Vehicle

Once you have your comprehensive gifted car document in hand, the next step is often dealing with your local Department of Motor Vehicles (DMV) or equivalent state agency. Each state has its own specific procedures and required forms for transferring vehicle titles, even for gifted cars. It’s a good idea to check your state’s DMV website or call them directly to understand their exact requirements. Typically, you’ll need the current title, the completed gift document (serving as your bill of sale for gifted car template), and identification for both parties, and sometimes other forms like an odometer disclosure statement.

One of the primary benefits of properly documenting a gifted vehicle is navigating sales tax. Most states offer an exemption from sales tax when a vehicle is gifted between immediate family members. However, proving this relationship and the “gift” status requires clear documentation. Without it, the recipient might be assessed sales tax based on the vehicle’s market value, which can be a significant unexpected cost. The specific language in your gift document confirming no monetary exchange is key to claiming this exemption.

Beyond sales tax, donors should also be aware of potential federal gift tax implications. While many gifts fall below the annual exclusion limit (which can change yearly), very high-value vehicles might push a donor into a taxable gift situation. It’s always wise to consult with a tax professional if the vehicle’s value is substantial, just to ensure you’re fully aware of any potential federal reporting requirements or tax liabilities. Most gifted cars between family members, however, will typically fall within the annual exclusion limits.

The final phase involves the recipient officially registering the vehicle in their name and obtaining new license plates. The gift document is crucial here, as it serves as proof of ownership transfer, allowing the DMV to issue a new title. Ensuring all forms are accurately filled out and submitted promptly not only secures the new owner’s legal rights but also releases the original owner from liability, making for a smooth and worry-free transition for everyone involved.

Taking the time to properly document the transfer of a gifted car might seem like an extra step, but it is an invaluable one. By using a clear and comprehensive document, you ensure that both the donor and the recipient are protected legally and financially. This diligent approach helps avoid future complications, making the joyous act of giving a car a truly seamless experience for all parties involved.