When you decide to give a valuable asset to someone, be it a car, a boat, a piece of art, or even a cherished pet, the gesture itself is often filled with warmth and generosity. While money might not be changing hands, the act of transferring ownership of a significant item still carries legal and practical implications that are important to address. Simply handing over the keys or the item might seem sufficient in the moment, but it can lead to complications down the road.

This is where a document like a bill of sale specifically designed for gifts comes into play. It serves as official proof that the item has changed hands, not as a sale, but as a genuine gift. Understanding the necessity and components of such a document can save both the giver and the recipient from potential headaches related to registration, taxes, or future disputes, ensuring a smooth and clear transfer of ownership.

Why You Need a Bill of Sale for a Gift

Even though a gift implies no monetary exchange, formal documentation is incredibly valuable. A bill of sale for a gifted item acts as crucial legal evidence of the ownership transfer. This is particularly important for items that require registration, such as vehicles or boats. Without it, the new owner might face significant hurdles when trying to register the item in their name, as motor vehicle departments or other registration bodies typically require proof of how the item was acquired.

Beyond registration, having a clear paper trail is vital for tax purposes. While most gifts between individuals are not immediately taxable to the recipient, larger gifts might have implications for the giver under gift tax rules, depending on the value and applicable annual exclusions. A bill of sale clearly stating the item was a gift and its value (or lack of monetary consideration) provides necessary documentation for both parties should questions arise from tax authorities. It establishes the nature of the transaction and can help avoid misinterpretations that could lead to unexpected tax liabilities.

Furthermore, a properly executed bill of sale offers a layer of liability protection for the giver. Imagine gifting a vehicle that is later involved in an accident. Without clear documentation of the ownership transfer date, the previous owner could theoretically be held responsible. The bill of sale unequivocally marks the point at which ownership, and thus responsibility, transferred to the recipient, protecting the giver from potential legal issues arising after the gift was made.

Finally, using a formal document brings clarity and peace of mind. It prevents misunderstandings between the giver and the recipient and provides an undeniable record for future reference. This is especially helpful if the item is later sold or if there are questions about its history.

Key Reasons to Use One

- Provides legal proof of ownership transfer.

- Facilitates easy registration with government agencies.

- Aids in accurate tax reporting for both parties.

- Protects the giver from future liability.

- Ensures clarity and prevents disputes.

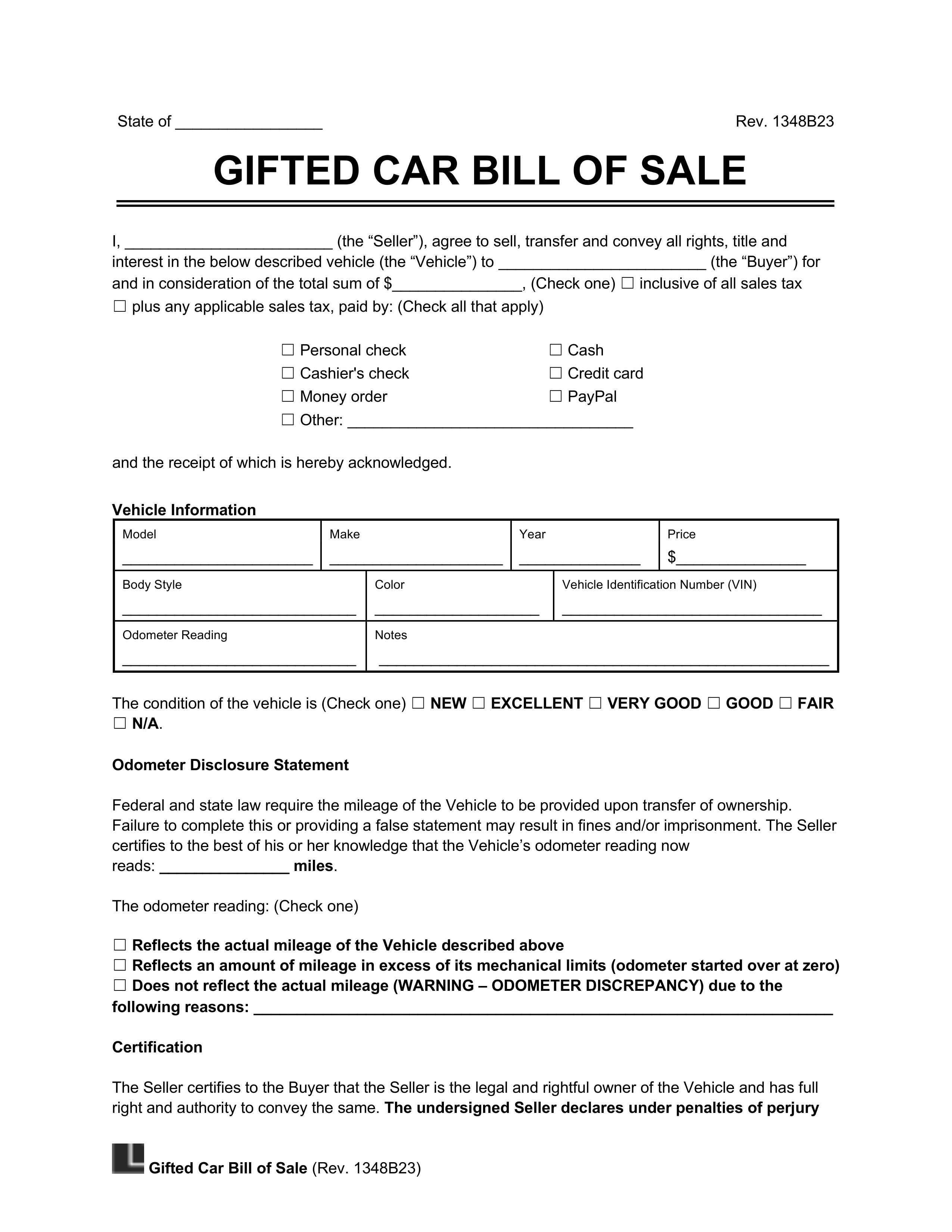

What to Include in Your Bill of Sale as Gift Template

Creating a comprehensive and legally sound bill of sale for a gifted item doesn’t have to be complicated, but it does require attention to detail. The document needs to clearly identify all parties involved. This means including the full legal names and current addresses of both the giver (donor) and the recipient (donee). Accurate identification of both parties is fundamental to establishing the validity of the transfer.

Next, the gifted item itself must be described in sufficient detail to avoid any ambiguity. For a vehicle, this would include the make, model, year, vehicle identification number (VIN), odometer reading, and license plate number. For other items, include serial numbers, unique identifiers, or specific characteristics that clearly distinguish the item. The condition of the item at the time of the gift can also be briefly noted, which can be helpful for future reference.

Crucially, the bill of sale must explicitly state that the item is being transferred as a gift, and that no monetary consideration or payment is being exchanged for it. Phrases such as “for love and affection” or “as a gift with no monetary consideration” are commonly used to make this clear. It is important to avoid any language that might suggest a sale, even if the price is listed as zero dollars, unless that is specifically required by your local jurisdiction for tax or registration purposes.

Finally, the document must be dated and signed by both the giver and the recipient. The date of the transfer is critical for establishing when ownership officially changed hands. While not always legally required, having the signatures notarized can add an extra layer of legal validity and authenticity to the document, making it more robust in the event of any future disputes or legal challenges. Consider local regulations regarding notarization, especially for high-value items like vehicles or real estate.

Ensuring your bill of sale as gift template includes all these elements will make the process of gifting smooth and legally secure for everyone involved. A well-prepared document provides peace of mind and simplifies any administrative steps required after the gift has been given. By taking the time to properly document the transfer, you are ensuring that your generous act is both appreciated and legally sound for years to come.