A bill of exchange serves as a foundational instrument in both domestic and international trade, providing a clear and legally binding order for payment. It acts as a promise from one party to pay a specified sum of money to another party on a particular date or on demand. Understanding its structure and correct execution is crucial for businesses engaging in transactions that require formal financial commitment.

For anyone involved in trade, from small businesses to large corporations, the intricacies of financial documentation can be daunting. This is where having a reliable bill of exchange draft template becomes invaluable. It not only simplifies the process of creating these complex documents but also helps ensure accuracy, compliance, and clarity, minimizing potential disputes and streamlining your financial operations.

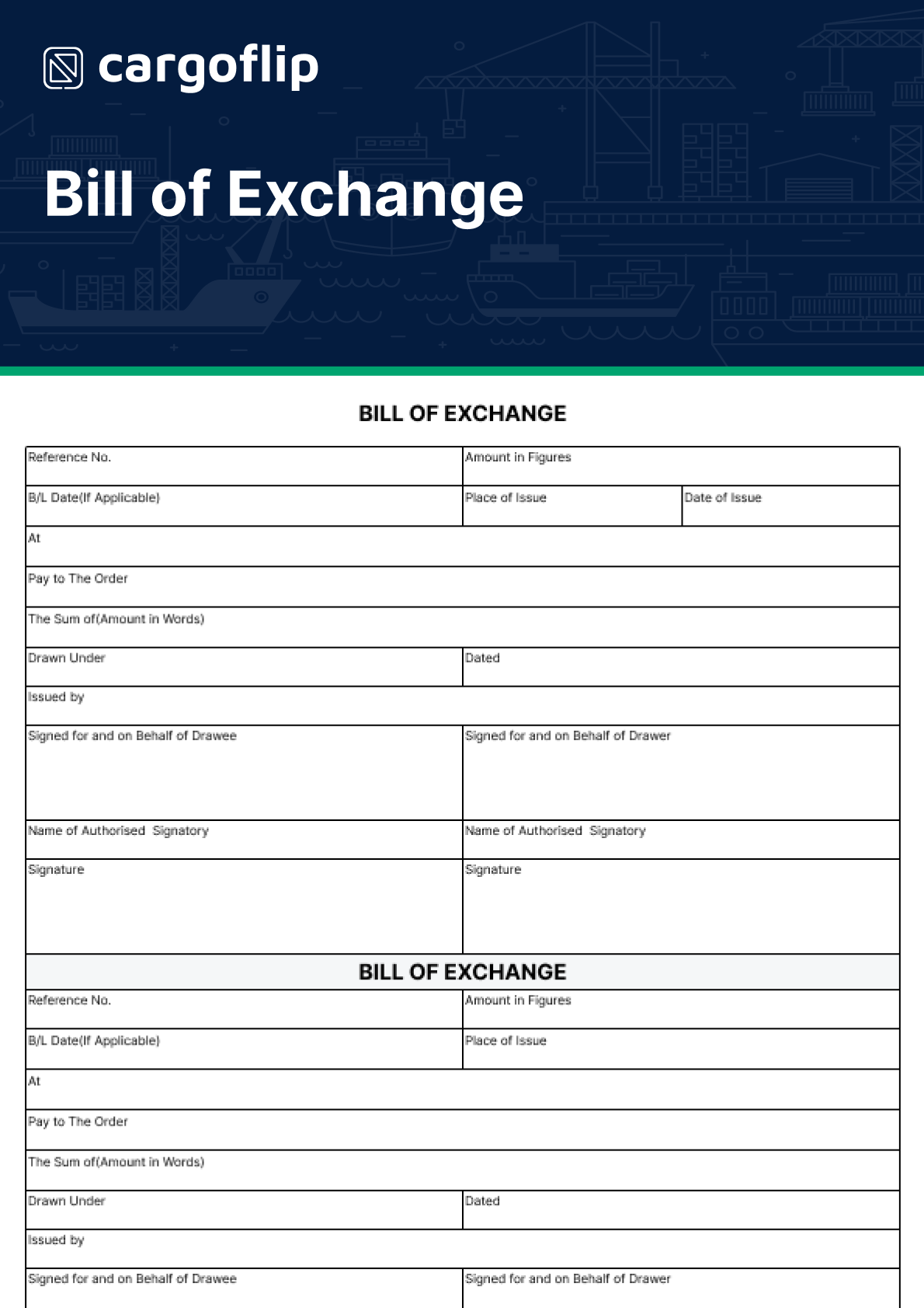

Understanding the Core Components of a Bill of Exchange

At its heart, a bill of exchange is a three-party financial instrument that facilitates payment without the immediate exchange of cash. It is essentially an unconditional order in writing, signed by the person giving it, requiring the person to whom it is addressed to pay a sum certain in money to or to the order of a specified person, or to the bearer, on demand or at a fixed or determinable future time. This legal definition highlights its power as a secure payment mechanism, particularly in cross-border transactions where trust and clear terms are paramount.

The parties involved are distinct and each plays a vital role in the bill’s lifecycle. First, there’s the ‘Drawer’, who is the person or entity issuing the bill and ordering payment. Then, we have the ‘Drawee’, the party on whom the bill is drawn, usually the buyer or debtor, who is required to make the payment. Finally, the ‘Payee’ is the person or entity to whom the payment is to be made, which could be the drawer themselves or a third party. Clearly identifying these roles is essential for the bill’s validity and enforceability.

Every component of a bill of exchange contributes to its legal validity and effectiveness. Without a clear date, for instance, the payment terms might be ambiguous. If the amount is not stated unequivocally, the bill becomes unenforceable. The signatures of the relevant parties authenticate the document, while specific terms of payment, such as ‘on demand’ or ‘at sight’ or ‘after date’, define when the payment becomes due. These details collectively transform a simple piece of paper into a powerful legal instrument for financial commitment.

Imagine you are conducting international trade, and a precise, legally sound document is needed to secure payment from an overseas buyer. This is where a well-structured bill of exchange draft template truly shines, ensuring all necessary elements are included and correctly formatted, preventing costly errors or misunderstandings. It provides a standardized framework, making the creation of these critical documents less prone to human error and more efficient.

Key Information to Include in Your Bill of Exchange

- Date of Issue: The date the bill is created.

- Specific Amount: The exact sum of money to be paid, both in figures and words.

- Parties Involved: Full names and addresses of the Drawer, Drawee, and Payee.

- Payment Terms: Clearly state when the payment is due (e.g., “on demand,” “60 days after sight”).

- Place of Issue and Payment: Where the bill was drawn and where payment is to be made.

- Unconditional Order: The instruction to pay must be absolute, without any conditions attached.

- Signature of the Drawer: The legally binding signature of the person issuing the bill.

Why a Bill of Exchange Draft Template is Indispensable for Your Business

In today’s fast-paced business environment, efficiency and accuracy are paramount. Relying on a robust bill of exchange draft template offers numerous advantages that can significantly impact your operational flow and financial security. Firstly, it ensures consistency across all your transactions. When you use a standardized template, every bill of exchange you issue will contain all the necessary legal and financial information in the correct format, reducing the chances of omissions or clerical errors that could invalidate the document or lead to disputes.

Beyond consistency, a good template saves a considerable amount of time. Instead of drafting each bill from scratch, you simply fill in the specific details for each transaction. This automation frees up valuable resources that can be redirected to other critical business activities. For businesses dealing with a high volume of transactions, this time-saving aspect alone can translate into significant operational efficiencies and reduced labor costs. It simplifies a complex legal process into a straightforward data entry task.

Furthermore, a well-designed bill of exchange draft template often incorporates best practices and legal requirements, acting as a guide to ensure compliance. It minimizes the risk of legal challenges by prompting you to include all mandatory fields and adhere to generally accepted commercial standards. This not only protects your interests but also fosters trust with your trading partners, demonstrating professionalism and adherence to proper financial protocols.

Consider the complexity of international trade, where different legal jurisdictions might have nuanced requirements. While a universal bill of exchange draft template may not cover every single localized nuance, it provides a powerful, universally recognized base that can be easily adapted. It gives you a strong starting point, making it simpler to modify for specific regional needs or unique contractual agreements, thus streamlining your global commercial activities and providing a foundation of certainty in diverse trade environments.

Embracing the use of a properly structured bill of exchange is more than just a matter of formality; it is a strategic decision that enhances the security and clarity of your financial dealings. By providing an unconditional order to pay, these instruments solidify commitments and provide a traceable record of obligations, fostering greater confidence in commercial interactions.

Ultimately, leveraging such a tool empowers your business with greater control over its financial processes. It helps to mitigate risks, streamline operations, and ensure that every transaction, whether domestic or international, is handled with the utmost precision and legal compliance. This foundational approach contributes significantly to building robust and trustworthy business relationships that can thrive in a dynamic global marketplace.