Are you constantly feeling like your money vanishes before your next paycheck arrives, leaving you scrambling to cover bills? It’s a common scenario for many, and it often stems from not having a clear picture of where your money is going. Managing your finances effectively can feel like a daunting task, especially when bills seem to pile up at different times of the month.

But what if there was a simpler way to keep track, reduce financial stress, and even find opportunities to save? That’s where a well-structured budget comes in. Specifically, for those who get paid every two weeks, aligning your budgeting process with your pay cycle can be a game-changer. A bi weekly bill budget template is designed to do just that, offering a clear roadmap for your money management.

Why a Bi-Weekly Budget Just Makes Sense for Many

For a significant number of people, paychecks arrive every two weeks. If that sounds like you, then trying to force your budget into a monthly cycle that doesn’t align with your income can feel like trying to fit a square peg in a round hole. A bi-weekly budget naturally syncs with your income flow, providing a more accurate and immediate picture of your financial standing after each payday. This method allows you to allocate funds as soon as they hit your account, reducing the chance of overspending and ensuring that upcoming bills are accounted for well in advance.

Imagine the peace of mind knowing that when your paycheck lands, you already have a plan for every dollar. It’s not just about tracking; it’s about strategic allocation. This approach helps prevent that mid-pay cycle panic when you realize a big bill is due, and you’re not sure if the funds are available. By breaking your financial planning into shorter, more manageable chunks, you can catch potential shortfalls quicker and make adjustments on the fly, rather than waiting until the end of a longer monthly period when it might be too late.

Moreover, a bi-weekly rhythm often means you’ll have two extra “paycheck” months each year. While these aren’t truly extra paychecks in the sense of more money overall, they can feel like a bonus when you budget bi-weekly. These extra pay periods can be strategically used for building up your emergency fund, tackling debt, or reaching specific savings goals, giving your financial progress an unexpected boost. It fosters a more proactive and less reactive approach to your money.

Ultimately, adopting a bi-weekly budget can simplify your financial life, provide clearer insights into your spending habits, and empower you to make more informed decisions about your money. It shifts the focus from merely surviving paycheck to paycheck to actively building a more secure financial future, one pay period at a time. It’s about creating a sustainable financial rhythm that works *for* you.

Key Components to Include in Your Template

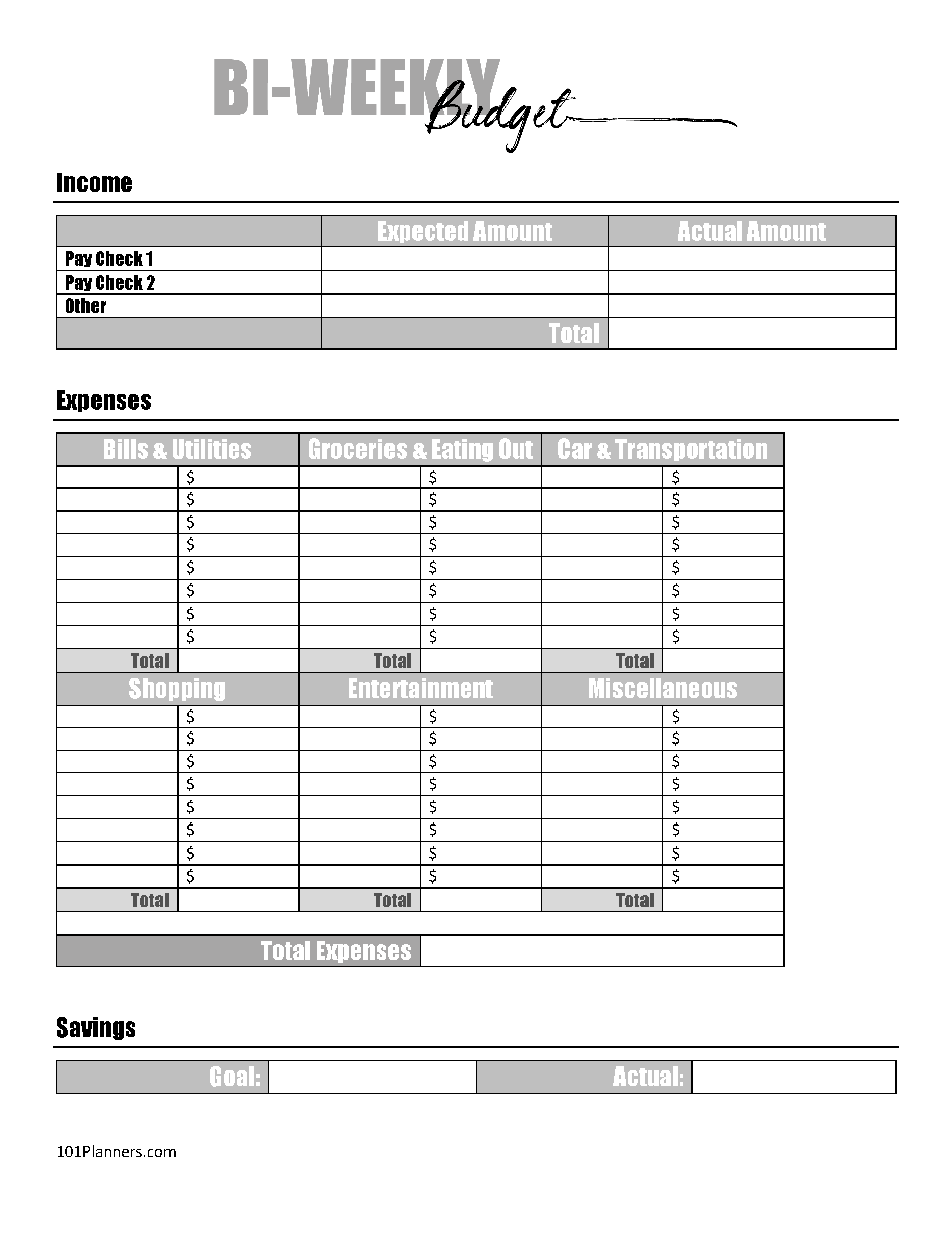

To make your bi weekly bill budget template truly effective, it needs to capture the essentials. This isn’t just a list of numbers; it’s a living document that guides your financial decisions. Here are the core elements you should include:

- Income Sources: List all income you expect to receive during the two-week period. This might include your primary salary, freelance income, or any other regular payments.

- Fixed Expenses: These are bills that typically remain the same amount each period, such as rent or mortgage payments, loan installments, insurance premiums, and subscriptions.

- Variable Expenses: This category covers costs that fluctuate, like groceries, utilities, transportation (gas), dining out, and entertainment. This is often where most budgeting adjustments happen.

- Savings Goals: Dedicate a portion of each paycheck towards your savings objectives, whether it’s an emergency fund, a down payment for a house, or a future vacation.

- Debt Payments: Clearly outline minimum payments for credit cards, student loans, or any other debts, and ideally, plan for extra payments if possible.

How to Effectively Use Your Bi-Weekly Bill Budget Template

Getting your bi weekly bill budget template set up is just the first step; the real magic happens in how you use it consistently. Begin by gathering all your financial information. This means knowing exactly what your net income is for each bi-weekly period and having a comprehensive list of all your bills and their due dates. Don’t forget those smaller, recurring charges you might overlook, like streaming services or app subscriptions, as they can add up quickly. Once you have a clear picture of your income, allocate funds to your fixed expenses first. These are your non-negotiables, the payments that absolutely must be made to keep your household running smoothly.

Next, it’s time to tackle your variable expenses. This is often the trickiest part for many people, as these categories tend to fluctuate. Instead of guessing, try to estimate based on your past spending habits. Look at your bank statements from the last few months to get an average for things like groceries, gas, and entertainment. Remember, this isn’t about deprivation; it’s about mindful spending. If you find yourself consistently over budget in one area, that’s a clear signal to either adjust your spending or reallocate funds from another category. This step is where your budget becomes a dynamic tool, adapting to your real-life needs.

Don’t forget to prioritize your savings and debt payments within each bi-weekly cycle. Even if it’s a small amount, consistently putting money towards these goals will make a significant impact over time. Think of these as payments to your future self. Once your budget is initially set up, the crucial next step is to track your spending diligently. This means logging every expense, no matter how small, to ensure you’re sticking to your plan. There are many apps and digital tools that can help with this, or even a simple spreadsheet can do the trick. The key is consistency.

Finally, make reviewing and adjusting your budget a regular habit. Life happens, and your financial situation will evolve. Bills might change, income could fluctuate, or new goals might emerge. Take time every two weeks, perhaps before your next paycheck arrives, to review how you performed against your budget. Identify areas where you did well and areas that need improvement. This ongoing process of review and adjustment is what transforms a static template into a powerful financial management system that truly serves your unique needs and helps you achieve your financial aspirations.

Taking control of your finances doesn’t have to be overwhelming or restrictive. By embracing a bi-weekly budgeting approach, you’re not just creating a financial document; you’re building a system that fosters awareness, reduces stress, and empowers you to make intentional choices with your money. This structured yet flexible method can transform your financial habits, leading to greater stability and the ability to reach your financial goals faster than you ever thought possible.

Starting today, you can begin to experience the profound sense of calm and confidence that comes from knowing exactly where your money stands. It’s about creating a clearer path to financial security, allowing you to live your life with less worry and more freedom.