Life is full of wonderful surprises, but it can also throw unexpected challenges our way. From minor mishaps to significant natural disasters, protecting your home and everything inside it is a top priority for most homeowners. While having a robust home insurance policy is the foundation of this protection, the real test often comes when you need to file a claim.

This is where being prepared truly pays off. Imagine trying to recall every single item you own, its purchase date, and value, all while dealing with the stress of a damaged home. It’s an overwhelming prospect. That’s why having a solid home insurance inventory list template isn’t just a good idea; it’s an essential tool for peace of mind and efficient recovery. It transforms a potentially chaotic situation into an organized process, ensuring you don’t miss anything important when communicating with your insurance provider.

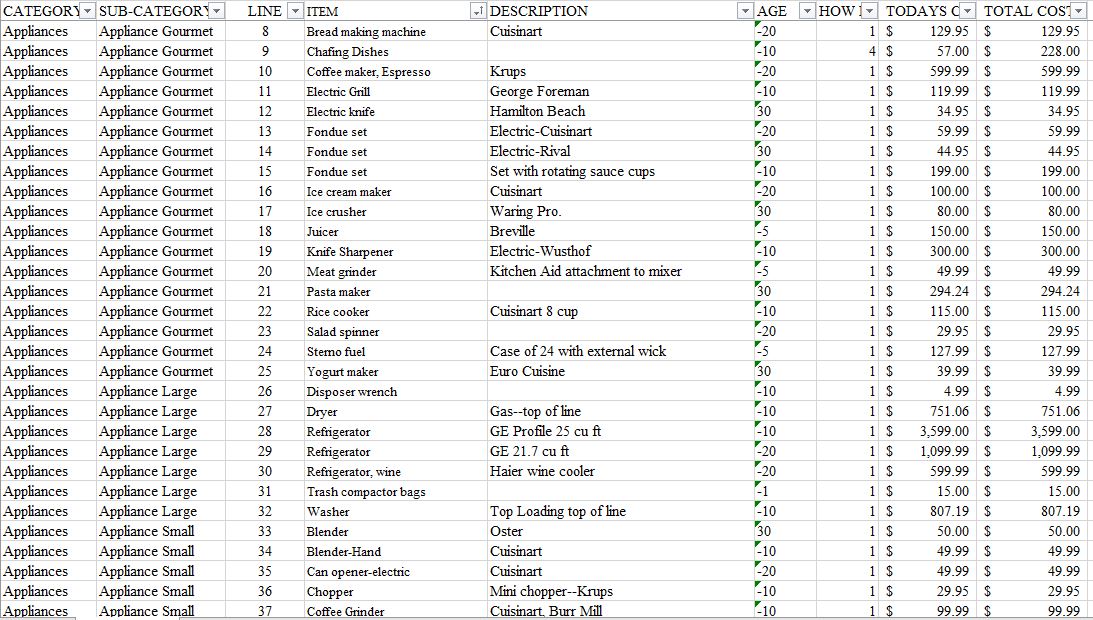

A thorough home inventory is your personal record of all your belongings, detailing their value and condition. It serves as irrefutable evidence for your insurance company, drastically speeding up the claims process and helping you receive fair compensation for your losses. This article will guide you through creating and utilizing an effective inventory, making sure you’re ready for whatever comes next.

Why a Home Inventory is Your Best Friend After a Disaster (or Before!)

Nobody wants to think about their home being damaged or losing precious belongings. Yet, life has a way of reminding us that the unexpected can indeed happen. When a fire, flood, theft, or other covered event strikes, the immediate aftermath is often a whirlwind of emotions and practical challenges. In such trying times, the thought of itemizing every single belonging you’ve lost can feel utterly impossible. This is precisely why a pre-prepared home inventory is invaluable; it removes a massive burden from your shoulders during an already stressful period.

Beyond just easing the emotional toll, a detailed inventory offers significant financial benefits. Without a comprehensive list, you might inadvertently forget to claim certain items, leading to an underpayment that leaves you financially short. An accurate inventory ensures you get the full value for your covered possessions, preventing disputes with your insurance company about what you owned or its worth. It provides a clear, objective record that supports your claim, making the entire process smoother and often much faster. Think of it as your financial safety net, meticulously documented item by item.

Furthermore, a well-structured inventory helps you understand the true value of your possessions, which can be crucial when reviewing or updating your insurance policy. Many people are surprised to learn how much their accumulated belongings are actually worth. This knowledge empowers you to ensure you have adequate coverage, preventing situations where your policy limits might be insufficient to replace everything you’ve lost. It’s not just about what you own, but also about knowing its collective worth.

Building a comprehensive inventory might seem like a daunting task at first glance, but with a good home insurance inventory list template, it becomes surprisingly manageable. Modern technology offers numerous ways to approach this, from simple spreadsheets to dedicated mobile apps, each designed to simplify the process of documenting your possessions. The key is to break it down into smaller, manageable steps, tackling one room or one category of items at a time.

Getting Started with Your Inventory Journey

To begin, you’ll want to gather some essential information for each item. This isn’t just about listing "TV"; it’s about providing enough detail to prove ownership and value.

Here’s what you should aim to include:

- Item Description: Be specific (e.g., "55-inch Samsung Smart TV, Model QN55Q60AAFXZA").

- Purchase Date: When did you acquire the item?

- Original Purchase Price: What did you pay for it?

- Current Value/Replacement Cost: What would it cost to replace today? (Especially important for older items where value may have appreciated, like antiques, or depreciated, like electronics.)

- Serial Number: Crucial for electronics and appliances.

- Photos or Videos: Visual proof is incredibly powerful. Take clear pictures of individual items and general room overviews. Videos can pan across rooms, narrating items as you go.

- Receipts/Appraisals: Keep digital copies (scans) of receipts, warranties, and professional appraisals for high-value items like jewelry, art, or collectibles.

Remember to store your inventory securely, preferably off-site or in the cloud, so it’s accessible even if your physical home and its contents are destroyed. Regular updates, perhaps annually or after significant purchases, are also essential to keep it accurate and reflective of your current belongings.

Maximizing Your Home Inventory for a Smooth Claim

Creating an inventory isn’t just a checklist; it’s about building a robust case for your insurance claim. The more detailed and well-supported your home inventory list is, the smoother and more successful your claim process will likely be. It’s about leaving no room for doubt regarding what you owned and its value. This level of thoroughness can significantly reduce the back-and-forth often associated with claims, allowing you to focus on rebuilding and recovery.

Beyond simply listing items, the power of your inventory lies in the supporting documentation. Imagine telling your insurer you had a specific antique watch versus showing them a photo of the watch, its appraisal certificate, and the receipt from its purchase. The latter leaves no question. Digital storage solutions for these documents are key; scan all receipts, warranties, and appraisal documents and link them directly to the corresponding items in your digital inventory. This creates an interconnected web of evidence that is incredibly compelling during a claim assessment.

Finally, take the time to truly understand your home insurance policy. Knowing your coverage limits, deductibles, and the difference between actual cash value and replacement cost coverage for personal property is vital. Your detailed inventory allows you to align your losses with your policy’s provisions. For instance, if you have high-value items like specific jewelry or art, your policy might require them to be itemized separately (scheduled) to be fully covered. Your comprehensive home insurance inventory list template will highlight these items, prompting you to ensure they are adequately protected under your specific policy terms before disaster ever strikes.

Having a meticulously compiled and regularly updated home inventory is one of the smartest things you can do as a homeowner. It’s an investment of time that pays dividends in peace of mind, knowing that should the worst happen, you have a clear path to recovery. It empowers you with the information you need to navigate the complexities of an insurance claim, ensuring you receive fair compensation for your valued possessions.

Don’t wait for a disaster to highlight the need for organization. Start building your home inventory today; it’s a proactive step that provides invaluable security and simplifies your life during moments of crisis. A little effort now can save you immense stress and potential financial loss down the road.