Experiencing a house fire is undoubtedly one of the most devastating events a person can face. Beyond the immediate shock and emotional toll, dealing with the aftermath can feel overwhelming. The physical damage to your home and belongings leaves you with a daunting task: documenting everything that was lost or damaged for insurance purposes. It is a moment when clarity and organization are desperately needed, yet often difficult to achieve.

This is precisely where a well-structured fire loss inventory list template becomes an invaluable tool. It acts as your guide through the chaos, helping you systematically record every item, its condition, and its estimated value. Having such a document ready, or knowing how to create one quickly, can significantly streamline your insurance claim process and ensure you receive the compensation you deserve to begin rebuilding your life.

In this article, we will explore the critical elements of an effective inventory template, why it is so crucial for your recovery, and provide practical advice on how to use it to your best advantage. Our aim is to equip you with the knowledge to navigate this challenging period with a little more ease and a lot more organization.

Why a Detailed Fire Loss Inventory Template is Your Best Ally

When a fire strikes, the scene can be disorienting and emotionally draining. Trying to recall every single item you owned from memory, especially in a state of distress, is an almost impossible task. A fire loss inventory list template removes this immense burden by providing a structured framework. It prompts you to think systematically, room by room, item by item, ensuring that nothing important is overlooked. This methodical approach is not just about convenience; it is about accuracy and completeness, which are vital for a successful insurance claim.

Insurance companies require detailed proof of loss to process your claim effectively. Without a comprehensive inventory, adjusters may struggle to assess the full extent of your damages, potentially leading to a lower settlement than you are entitled to. A well-prepared template, filled with specific details, acts as irrefutable evidence of your possessions, making the adjuster’s job easier and speeding up the entire process. It transforms a subjective recollection into an objective, documented record.

An effective fire loss inventory goes beyond just listing items; it encourages you to document their condition before the fire, their approximate age, and their replacement cost. This level of detail helps your insurance provider understand the true value of what was lost. Think about the multitude of items in your living room alone: electronics, furniture, books, decorations, personal photos. Each holds value, both monetary and sentimental, and each needs to be accounted for.

Furthermore, creating an inventory can be an emotionally taxing process, as it forces you to confront the loss repeatedly. However, by using a template, you can approach this task with a sense of purpose and control, knowing that each entry contributes to your recovery. It transforms a reactive chore into a proactive step towards rebuilding. It is about empowering yourself in a situation where you might feel powerless.

The process of filling out this template can also bring peace of mind. Knowing that you have meticulously documented your losses can reduce anxiety about forgetting items or not getting fair compensation. It’s a tangible step towards moving forward, providing a clear path amidst uncertainty.

Key Sections of a Comprehensive Inventory

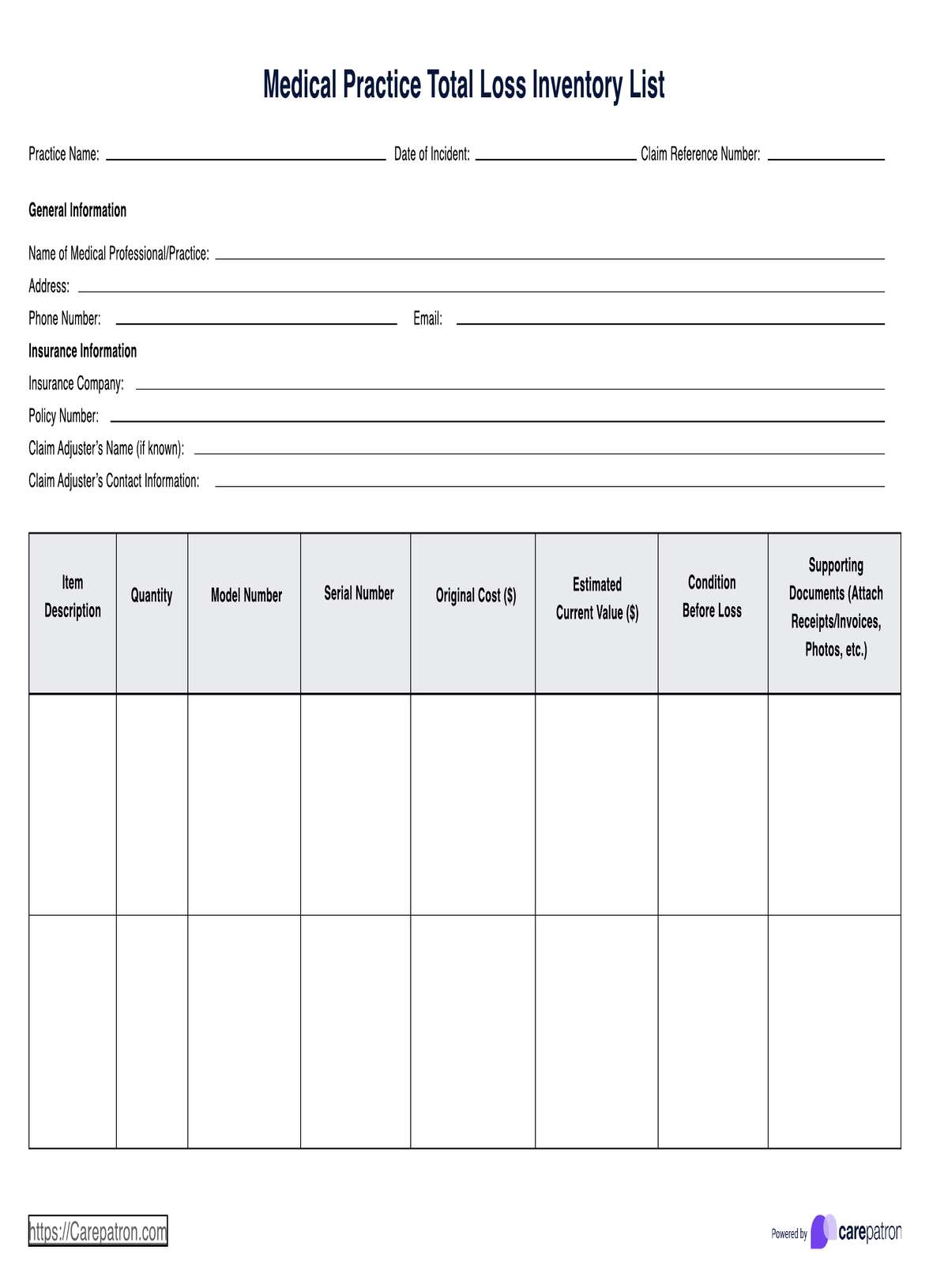

A robust fire loss inventory list template should typically include the following crucial sections to ensure you capture all necessary details for your insurance claim:

* Personal Information Your name, contact details, policy number.

* Date of Loss The specific date when the fire occurred.

* Room by Room Breakdown A systematic listing of rooms (e.g., kitchen, living room, bedroom 1), helping you recall items more easily.

* Item Description A clear, concise description of each lost or damaged item (e.g., “Sofa, three-seater, brown leather”).

* Estimated Value The approximate replacement cost of the item. Researching similar new items can help.

* Proof of Ownership Where applicable, note if you have receipts, photographs, or credit card statements that prove you owned the item.

* Damage Level Briefly describe the extent of fire, smoke, or water damage to the item.

* Notes/Comments Any additional relevant information, such as sentimental value or specific features.

Steps to Effectively Use Your Fire Loss Inventory List Template

The most effective way to utilize a fire loss inventory list template is to start filling it out *before* a disaster strikes. While it might seem like a daunting task, creating a home inventory proactively can save you immense stress and time in the event of a fire. Go room by room, taking photos or videos of your belongings, and list expensive items with their purchase dates and estimated values. Store this pre-emptive inventory in a secure, off-site location, such as a cloud service or a safe deposit box, ensuring it remains safe even if your home is destroyed.

After a fire, once it is safe to enter your property and you have permission from authorities, approach the documentation process methodically. Start with one room at a time, moving clockwise or counter-clockwise to ensure you do not miss anything. Do not rush this process. It is important to be thorough, even if it feels emotionally challenging. Take detailed notes and capture as much information as possible, referencing any pre-existing inventory you may have.

Gathering supporting documentation is just as crucial as the inventory itself. The more evidence you can provide, the stronger your claim will be. This includes not just your detailed list but also visual proof and purchase records.

* Take photos and videos of the damaged items and areas before anything is cleaned or removed. Capture different angles and close-ups.

* Gather receipts, credit card statements, and bank statements that show proof of purchase for expensive items. If you have warranties or appraisals, include those too.

* Contact your insurance provider immediately after the fire to report the loss and understand their specific claim filing procedures. They can often provide guidance during this difficult time.

* Store copies of everything digitally and physically in a secure, off-site location. This includes your completed inventory, photos, receipts, and communication with your insurance company.

Having a meticulously completed inventory and supporting documentation ready makes the claims process significantly smoother. It allows you to present a clear, detailed picture of your losses to your insurance adjuster, minimizing disputes and facilitating a quicker resolution. This preparation can truly make a difference in your journey toward recovery and rebuilding after a fire.