When you’re buying or selling something valuable, whether it’s a vehicle, a boat, or even a piece of specialized equipment, having a clear record of the transaction isn’t just a good idea—it’s often a necessity. This crucial document, known as a bill of sale, acts as a legal receipt, proving the transfer of ownership from one party to another. It’s designed to protect both the buyer and the seller, ensuring that everyone involved is on the same page and that the details of the exchange are officially recorded.

For residents of Michigan, understanding the specific requirements and best practices for this document is particularly important. While a generic bill of sale might seem sufficient, having one tailored to state-specific considerations can save you a lot of hassle down the road. It helps clarify responsibilities, provides essential information for registration processes, and serves as undeniable proof should any questions or disputes arise later. Let’s explore why having a proper bill of sale is so vital and how you can utilize a reliable template for your next transaction.

Why a Michigan Bill of Sale is Indispensable

In Michigan, just like in many other states, a bill of sale isn’t always legally mandated for every single transaction, but it is highly recommended for almost any significant purchase or sale. Think of it as your legal safety net. For the seller, it provides proof that you no longer own the item, which is crucial for liability purposes, especially with vehicles or other items that could incur fines or responsibilities post-sale. For the buyer, it is undeniable evidence that you are now the rightful owner, essential for registration, insurance, and demonstrating clear title.

Consider the process of selling a used car. Without a bill of sale, if the new owner gets into an accident or racks up parking tickets, you might find yourself still legally tied to the vehicle. Conversely, as a buyer, imagine trying to register a recently purchased boat at the Secretary of State’s office without any proof of purchase. A comprehensive bill of sale streamlines these processes and prevents potential headaches by clearly outlining the details of the transaction, from the purchase price to the condition of the item at the time of sale.

This document is also vital for tax purposes. When you sell an item, particularly a large asset, the bill of sale can serve as a record for income tax considerations. For buyers, it might be necessary for calculating sales tax or for claiming exemptions if applicable. It helps ensure that both parties are compliant with state regulations and that all financial aspects of the transaction are transparently documented. It essentially closes the loop on the ownership transfer, making everything official and indisputable.

Moreover, having a clear and detailed bill of sale can prevent misunderstandings or disputes. Did the buyer claim the item had a feature you never mentioned? Was there a disagreement over the final price? A well-drafted bill of sale, signed by both parties, acts as a definitive record of the agreed-upon terms, leaving little room for misinterpretation. It truly is the cornerstone of a smooth and secure private sale or purchase in Michigan.

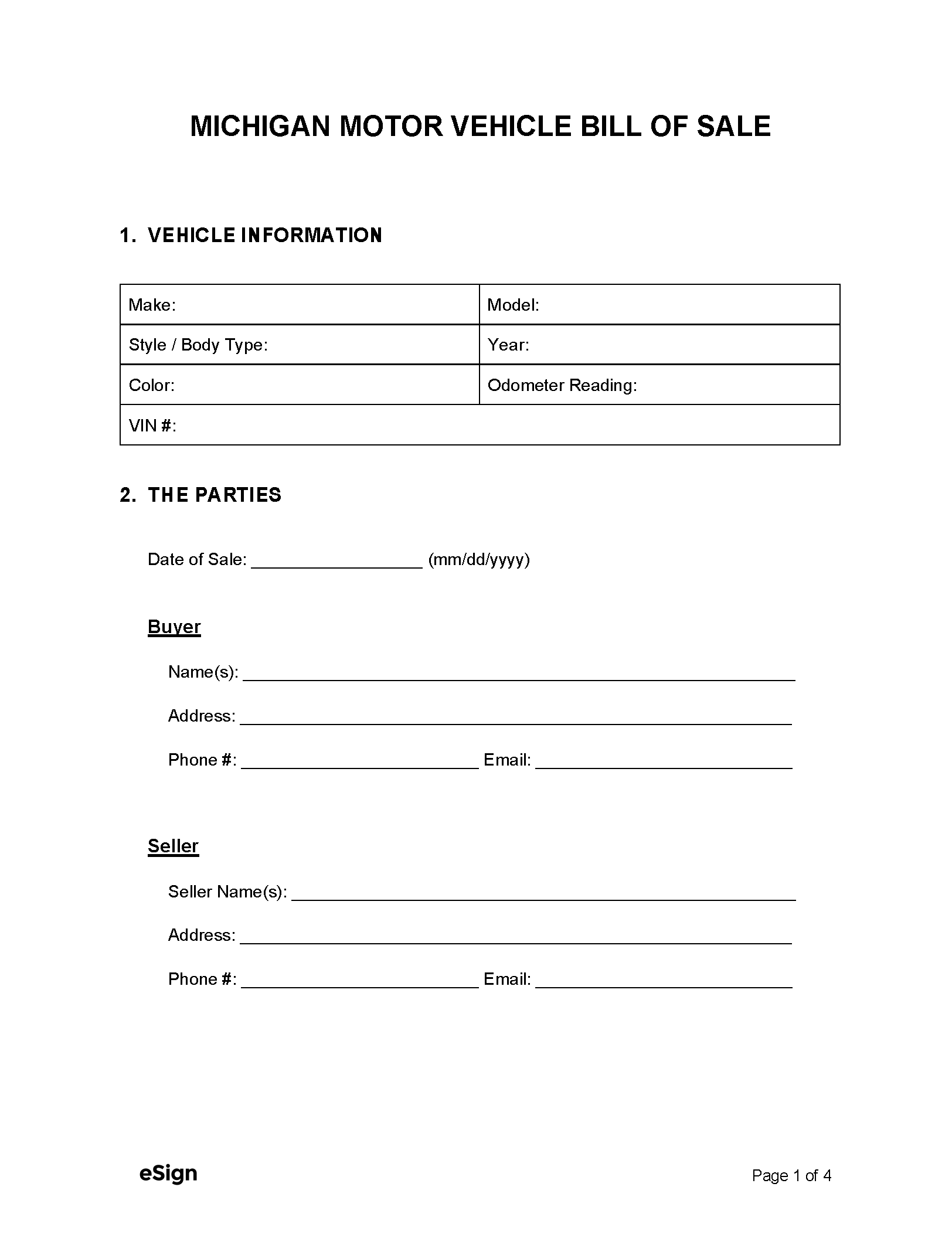

Key Elements to Include in Your Michigan Bill of Sale

-

Parties Involved: Full legal names and addresses of both the buyer and the seller.

-

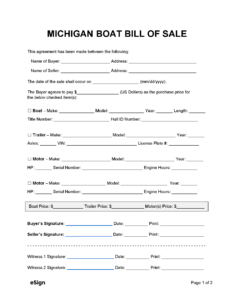

Item Description: A detailed description of the item being sold, including make, model, year, VIN (for vehicles), HIN (for boats), serial number, or any other identifying marks.

-

Purchase Price: The agreed-upon selling price of the item, clearly stated in both numerical and written form.

-

Date of Sale: The exact date the transaction occurred.

-

Payment Method: How the payment was made (e.g., cash, check, bank transfer).

-

Signatures: Signatures of both the buyer and the seller, affirming their agreement to the terms.

-

“As-Is” Clause (Optional but Recommended): For private sales, often includes a statement that the item is being sold “as-is,” meaning without any warranties or guarantees, which can protect the seller from future claims.

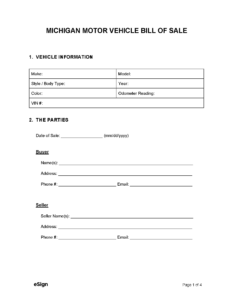

Accessing and Completing a Bill of Sale Template Michigan

Finding a reliable bill of sale template for Michigan is the first step towards a hassle-free transaction. Many state government websites, legal resource platforms, or reputable online document services offer templates specifically designed to meet Michigan’s general requirements. The beauty of using a pre-made template is that it guides you through all the necessary fields, ensuring you don’t miss any critical information that could lead to issues later on. It takes the guesswork out of drafting a legal document from scratch, providing a structured framework that is both comprehensive and easy to use.

Once you have your preferred template, the process of filling it out is straightforward but requires attention to detail. Accuracy is paramount. Double-check all names, addresses, and especially the identifying numbers of the item being sold, such as a vehicle identification number (VIN) or a boat hull identification number (HIN). Any discrepancies could invalidate the document or cause complications during registration. Make sure the agreed-upon price is clearly written, and if there are any specific conditions of the sale, like an “as-is” clause, ensure they are explicitly stated within the document.

After all the pertinent information has been entered, both the buyer and the seller must sign and date the bill of sale. It’s highly recommended that each party retains an original signed copy for their records. While notarization is not typically required for a standard bill of sale in Michigan, especially for private party transactions of personal property, it can add an extra layer of authenticity and legal weight. If you’re dealing with a particularly valuable asset or simply want maximum security, considering a notary public might be a wise choice, but always check if it’s necessary for your specific item and situation.

Finally, remember that the bill of sale is just one piece of the puzzle. For transactions involving vehicles, for instance, you’ll also need to consider the vehicle title, which must be properly signed over to the new owner. The bill of sale acts as a supporting document for the title transfer and is often required by the Michigan Secretary of State when registering the vehicle in the buyer’s name. Taking these steps diligently ensures a smooth and legal transfer of ownership, giving both parties peace of mind and protecting their interests.

Having a properly executed bill of sale is an indispensable part of any significant private transaction in Michigan. It clarifies the terms, validates the transfer of ownership, and provides a clear audit trail for legal, financial, and administrative purposes. Whether you are selling a used car, purchasing a piece of equipment, or transferring ownership of any valuable personal property, this document serves as your official record, protecting your rights and responsibilities.

By utilizing a reliable bill of sale template for Michigan and carefully completing all the required details, you can ensure a transparent and legally sound exchange. This simple step can prevent future disputes, simplify processes like vehicle registration, and ultimately provide both the buyer and the seller with invaluable peace of mind, making your transaction secure and stress-free.