Navigating the complexities of international trade can often feel like deciphering a secret code, especially when it comes to securing payments across borders. In this intricate global marketplace, a reliable and universally understood financial instrument is paramount. That’s where the bill of exchange steps in, serving as a crucial tool for businesses looking to facilitate smooth and secure cross-border transactions.

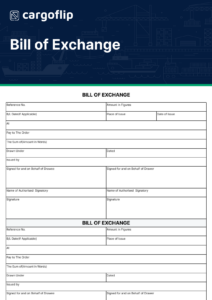

For many, the idea of drafting such a document from scratch can be daunting. Thankfully, you don’t have to be a legal expert or a seasoned trade financier to get it right. This article will demystify the international bill of exchange, break down its essential components, and guide you towards utilizing a pre-designed international bill of exchange template to streamline your payment processes and reduce potential risks in your global dealings.

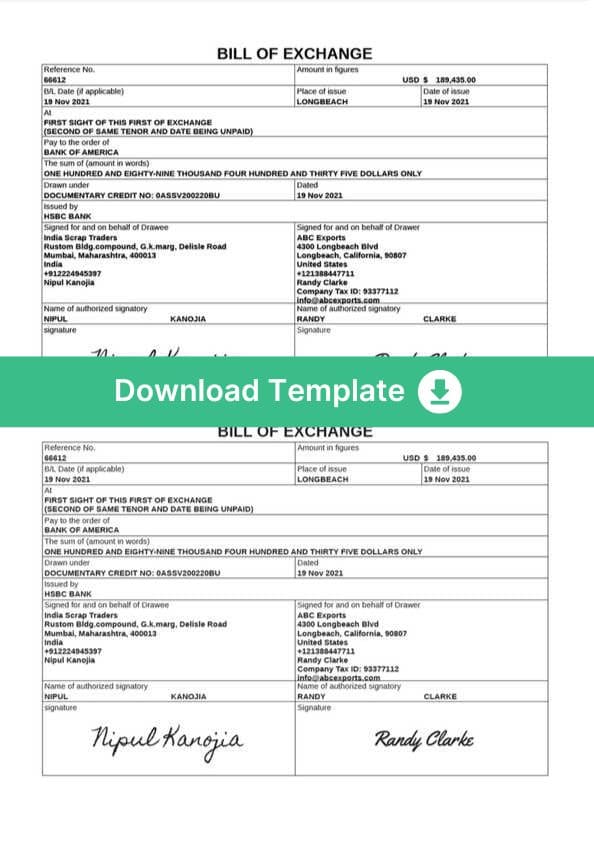

Understanding the Core Components of an International Bill of Exchange

At its heart, an international bill of exchange is a written order from one party (the drawer) to another (the drawee), instructing the drawee to pay a definite sum of money to a third party (the payee), either on demand or at a specified future date. This makes it a powerful instrument for both exporters and importers, offering a clear and legally binding framework for payment. It’s not just a promise; it’s an actionable instruction, transferable and often used in conjunction with other trade finance instruments like letters of credit.

The significance of a bill of exchange in international trade cannot be overstated. It provides a formal, documented commitment from the buyer (drawee) to pay the seller (payee), thereby reducing payment risk for the exporter. For the importer, it offers a clear understanding of their payment obligations and terms. This clarity and legal enforceability are precisely why businesses seek a well-structured international bill of exchange template.

Key Elements to Include

- **Date of Issue:** When the bill was created.

- **Amount:** The exact sum of money to be paid, typically written in both figures and words to prevent ambiguity.

- **Parties Involved:** Full legal names and addresses of the drawer (the party issuing the bill), the drawee (the party instructed to pay), and the payee (the party who receives the payment).

- **Place of Issue:** The city and country where the bill was drawn.

- **Maturity Date/Payment Terms:** Specifies when the payment is due (e.g., “on demand,” “30 days after sight,” or a specific date).

- **Unconditional Order:** A clear instruction to pay, without any conditions attached.

- **Signature of Drawer:** The authorized signature of the party issuing the bill, making it legally binding.

- **Acceptance by Drawee:** While not always present at the time of drawing, the drawee’s signature on the bill signifies their agreement to pay, transforming it into an “acceptance.”

Ensuring the accuracy and completeness of each of these elements is critical. Any error or omission can invalidate the bill or lead to costly disputes. This is where the systematic structure of an international bill of exchange template proves invaluable, guiding you through each necessary field and helping to minimize oversight.

By understanding these core components, you can appreciate the meticulous nature required when preparing such a document. A good international bill of exchange template simplifies this process significantly, providing pre-formatted fields and often includes helpful notes to ensure compliance with international standards.

Finding and Customizing Your International Bill of Exchange Template

With the critical role an international bill of exchange plays in global commerce, finding a reliable template is a practical first step for many businesses. You can typically find these templates on reputable online legal resource sites, business document platforms, or even through banking institutions that specialize in international trade finance. When searching, prioritize sources that offer templates compliant with international conventions like the Geneva Convention on Bills of Exchange or the Uniform Customs and Practice for Documentary Credits (UCP 600), depending on your specific transaction and regional requirements.

A high-quality template will not only provide the necessary fields but should also be presented in a clear, editable format, such as Word or PDF, allowing you to easily input your specific transaction details. Look for templates that are intuitive and don’t require extensive legal knowledge to understand. Some might even come with brief explanations for each section, which can be immensely helpful for those new to using these instruments.

Once you’ve selected an international bill of exchange template, the next crucial step is customization. While the core structure remains constant, every transaction is unique. You’ll need to accurately input the names and addresses of all parties, the exact amount in both figures and words, the specific payment terms, and the precise date and place of issue. If your transaction involves specific clauses or conditions that are permissible under the law and do not violate the “unconditional order” principle, ensure these are clearly articulated within the template’s adaptable sections.

Always review the completed document carefully for any discrepancies before signing. For high-value transactions or if you have any doubts about the legal implications, it is highly advisable to seek counsel from a legal professional specializing in international trade law. They can ensure that your customized international bill of exchange template fully meets all legal requirements and protects your interests effectively, providing peace of mind as your goods and funds travel across the globe.

Utilizing a well-structured bill of exchange provides a clear, legally recognized framework for payment, instilling confidence in both the payer and the recipient. It significantly streamlines the financial aspect of global trade, reducing ambiguities and potential disputes that can arise from informal agreements or varied national payment customs.

By leveraging a reliable international bill of exchange template, businesses can confidently manage their international receivables and payables, fostering smoother transactions and stronger trading relationships worldwide. This proactive approach to documentation is key to success in the dynamic world of international commerce.