Buying or selling a car can be an exciting time, but it also involves a crucial piece of paperwork: the bill of sale. This document serves as a legally binding record of the transaction, protecting both the buyer and the seller from potential disputes down the road. It’s far more than just a receipt; it’s proof that ownership has officially changed hands.

For residents of the Bay State, understanding the specific requirements and best practices for this document is key to a smooth and compliant vehicle transfer. Whether you’re purchasing a used vehicle from a private seller or letting go of your old trusty ride, having a properly filled-out car bill of sale template massachusetts ensures that all the necessary details are captured accurately for your records and for the Massachusetts Registry of Motor Vehicles (RMV).

Why a Massachusetts Car Bill of Sale is Essential

When you’re dealing with a significant asset like a car, leaving things to verbal agreements is a recipe for potential trouble. A comprehensive car bill of sale acts as your primary legal defense, clearly outlining the terms of sale and the condition of the vehicle at the time of transfer. For sellers, it provides a paper trail proving you no longer own the vehicle, which is critical for liability purposes after the sale. Imagine getting a parking ticket or toll violation for a car you no longer own – without a bill of sale, proving your innocence can be a real headache.

For buyers, this document is equally vital. It confirms your legal ownership, a necessary step for titling and registering the vehicle in your name with the Massachusetts RMV. It also serves as evidence of the purchase price, which can be important for sales tax calculations or if there are any discrepancies later on. Without it, you might face challenges proving you actually bought the car, which could complicate everything from insurance claims to reselling the vehicle in the future.

Furthermore, a well-drafted bill of sale helps to prevent misunderstandings between parties. It locks down the agreed-upon price, clarifies the “as-is” condition if applicable, and lists any warranties (or lack thereof). This transparency minimizes the chances of disputes arising weeks or months after the deal is done, ensuring both parties walk away feeling secure about the transaction. In essence, it’s about safeguarding your interests and ensuring a clean legal break or beginning with your vehicle.

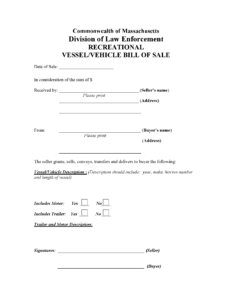

Key Information to Include in Your Massachusetts Car Bill of Sale

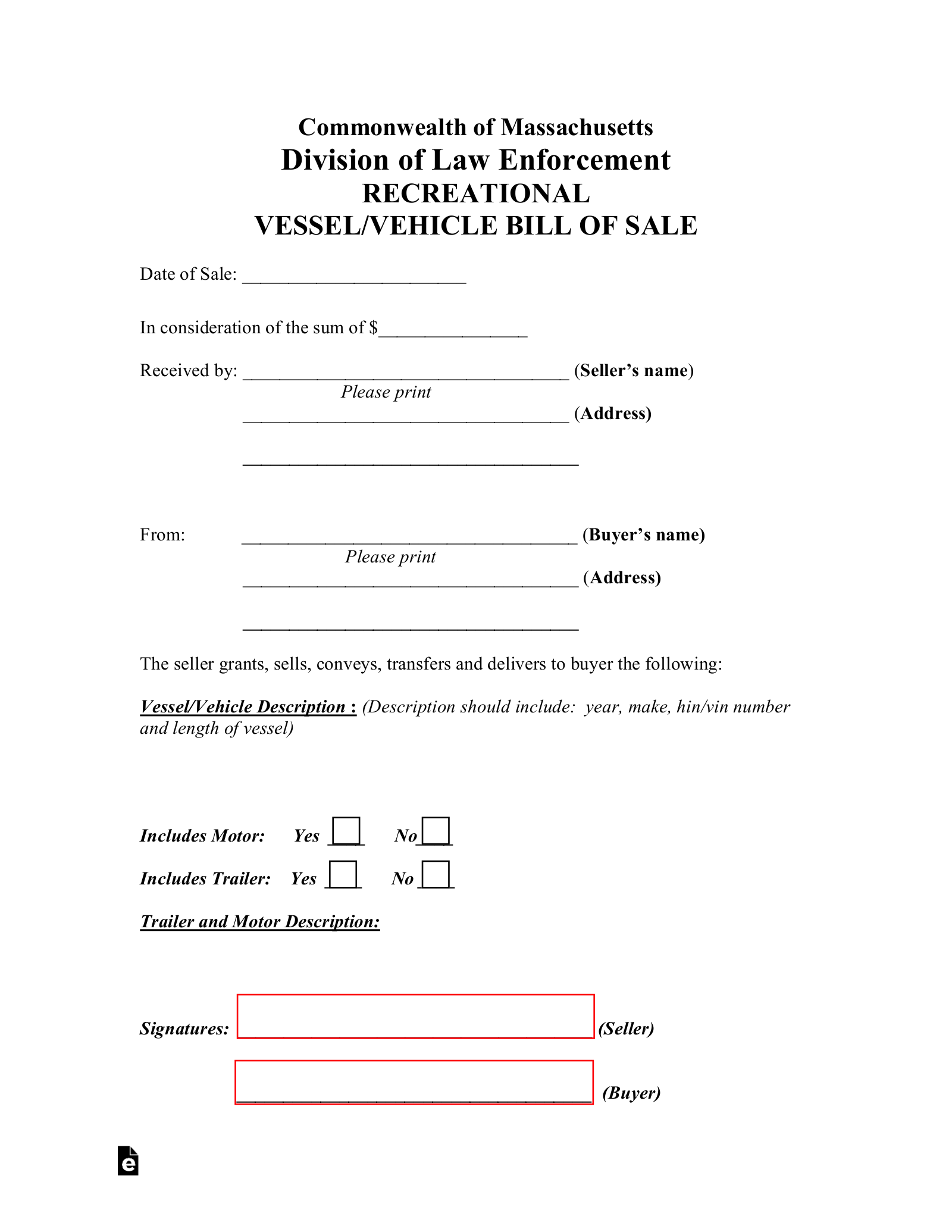

- Buyer’s Information: Full legal name, address, and contact details.

- Seller’s Information: Full legal name, address, and contact details.

- Vehicle Details: Make, model, year, Vehicle Identification Number (VIN), odometer reading (as required by federal and state law), and license plate number (if applicable).

- Purchase Price: The exact amount the vehicle is being sold for, both in numerical and written form.

- Date of Sale: The specific day, month, and year the transaction took place.

- Signatures: Both the buyer and seller must sign the document. It’s often recommended to have their signatures notarized for added legal weight, though not always strictly required for private sales in Massachusetts.

- “As-Is” Clause: A statement indicating that the vehicle is sold “as-is,” meaning without any warranties unless otherwise specified. This is very common in private party sales.

Steps After Completing Your Car Bill of Sale in Massachusetts

Once you’ve successfully completed and signed your car bill of sale, the process isn’t entirely finished, especially when dealing with a car bill of sale template Massachusetts. For the buyer, the immediate next steps involve transferring the vehicle’s title and registering it with the Massachusetts Registry of Motor Vehicles. You’ll typically need to present the bill of sale, the vehicle’s original title signed over by the seller, proof of Massachusetts auto insurance, and possibly a valid form of identification. Don’t delay this step, as driving an unregistered vehicle can lead to legal complications.

For the seller, your responsibilities also extend beyond simply handing over the keys. It’s crucial to remove your license plates from the vehicle immediately after the sale. In Massachusetts, you are required to cancel the registration associated with those plates through the RMV or transfer them to another vehicle within seven days. Failing to do so could result in liability for parking tickets or other violations incurred by the new owner while the plates are still linked to your name.

It’s also important for both parties to understand the sales tax implications. In Massachusetts, vehicles purchased from private parties are generally subject to a 6.25% sales tax on the purchase price or the National Automobile Dealers Association (NADA) book value, whichever is greater. This tax is typically paid by the buyer at the time of registration. Being aware of this can help you budget appropriately for your new vehicle.

Finally, always make sure to keep a copy of the signed bill of sale for your personal records. This document is your proof of transaction and can be invaluable if any questions or disputes arise in the future. Whether you’re the buyer or the seller, having this clear record provides peace of mind and simplifies any future dealings with the RMV or insurance companies.