When you’re sharing a meaningful gift with someone special, whether it’s a cherished family heirloom or a vehicle that will help them get around, the thought is what truly counts. However, for certain high-value items, the act of giving needs a bit more than just a heartfelt exchange. This is where a formal document can step in, ensuring clarity and providing a clear record of the transfer.

It might seem counterintuitive to use a “bill of sale” for something that isn’t being sold, but for gifts, especially those with significant value or items that require registration, a specialized version of this document becomes incredibly useful. It transforms a simple gift into a legally recognized transfer of ownership, protecting both the giver and the recipient from potential misunderstandings down the line.

Beyond Just a Bow: Why a Gift Needs a Bill of Sale

While the spirit of giving is often enough, the reality of transferring ownership for certain items, even as a gift, often requires a paper trail. Imagine gifting a car to your grandchild or a valuable piece of art to a museum; without proper documentation, proving the transfer of ownership can become surprisingly complicated. This isn’t about distrust; it’s about establishing clear records that protect everyone involved.

A formal gift bill of sale acts as undeniable proof that the item was indeed given as a gift, not merely loaned or misplaced. This is crucial for various reasons, from tax considerations to preventing future disputes among family members or heirs. For instance, if the recipient later needs to prove they own the item for insurance claims or to sell it themselves, having this document readily available simplifies the process immensely.

Common Scenarios Where a Gift Bill of Sale Shines

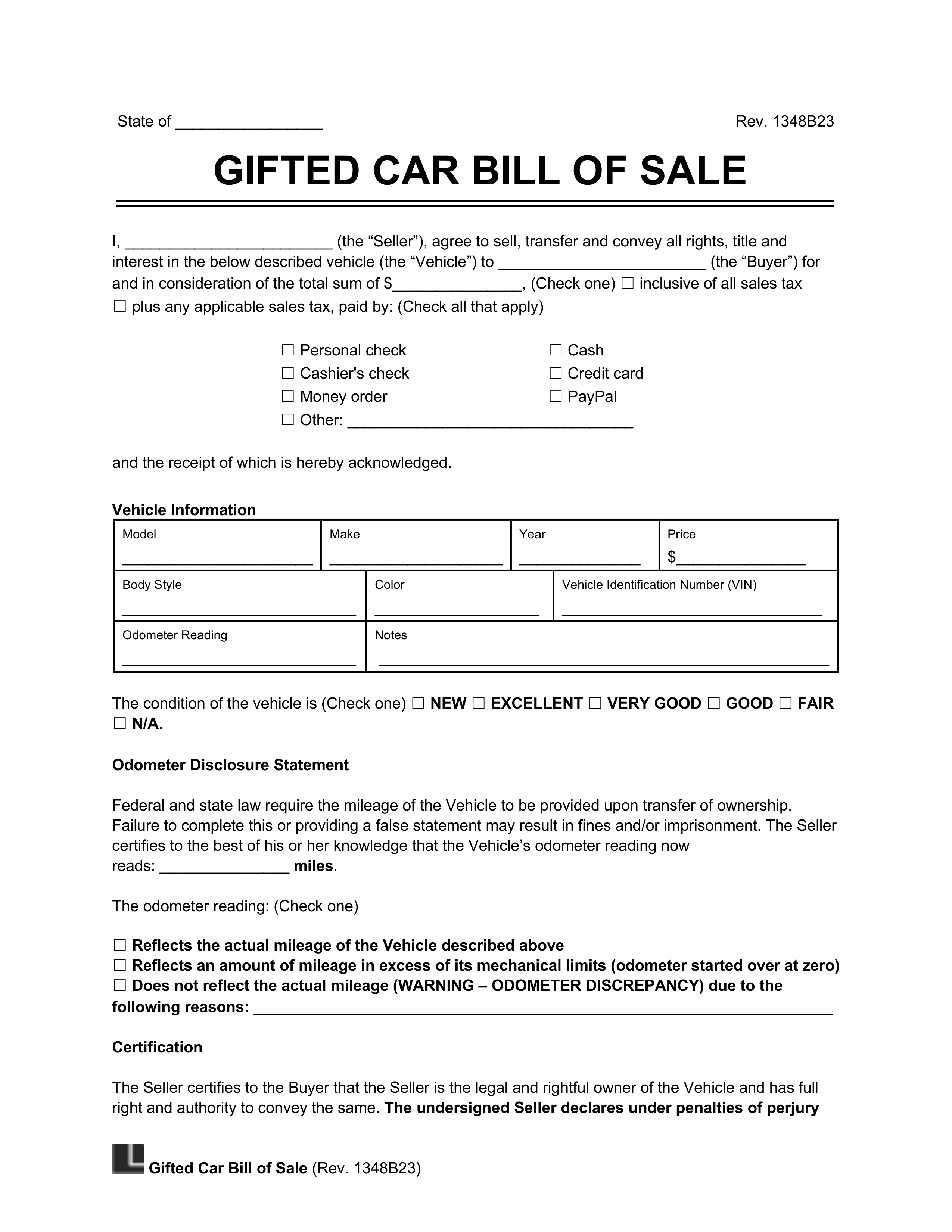

- Gifting a Vehicle: When a car, truck, or motorcycle is given as a gift, the recipient will need a bill of sale to register the vehicle in their name with the Department of Motor Vehicles (DMV). Without it, transferring the title can be impossible.

- Gifting a Boat or Other Registered Watercraft: Similar to vehicles, boats often require formal documentation for ownership transfer and registration with state or federal agencies.

- Gifting High-Value Items: For items like expensive jewelry, art pieces, or rare collectibles, a bill of sale can serve as proof of ownership for insurance purposes, estate planning, or to establish the chain of custody.

- Gifting to a Charity: If you’re donating a substantial item to a non-profit organization, a gift bill of sale can act as the official receipt, which is often necessary for tax deduction purposes.

Utilizing a well-crafted bill of sale gift template provides peace of mind. It formalizes the thoughtful act of giving, ensuring that your generosity is not only appreciated but also legally sound and hassle-free for the recipient. It’s a small step that can prevent large headaches.

Crafting Your Perfect Gift Bill of Sale

Creating a bill of sale for a gift doesn’t have to be a daunting task. The good news is that many of the elements found in a standard bill of sale are still relevant, with a key difference being the stated “consideration” for the transfer. Instead of a monetary amount, you will clearly state that the item is being transferred as a gift, with no money exchanged. This crucial detail distinguishes it from a typical sale transaction while maintaining its legal validity.

The primary goal of this document is to clearly identify the parties involved and the item being gifted. Think of it as painting a clear picture for anyone who might review the document later, whether it’s the DMV, an insurance company, or a legal professional. The more specific you can be, the better. This level of detail helps prevent any ambiguity about what was given and to whom.

It’s essential to include full and accurate details for both the donor (the giver) and the recipient. This means their legal names, current addresses, and contact information. These details establish who is transferring the item and who is receiving it, forming the foundation of the legal transfer. Incorrect or incomplete information can invalidate the document or cause issues later on.

The description of the gifted item is equally vital. For a vehicle, this would include the make, model, year, Vehicle Identification Number (VIN), odometer reading, and perhaps its color. For other items, a clear description, serial numbers if applicable, and any unique identifying marks should be noted. The goal is to describe the item so precisely that there’s no confusion about its identity. Finally, don’t forget the date of the transfer and the signatures of both the donor and the recipient, confirming their agreement to the terms of the gift.

Using a reliable bill of sale gift template streamlines this entire process, guiding you through each necessary field. It ensures that all the crucial legal and descriptive information is included, making the transfer smooth and legally sound. Both parties should retain a signed copy of the document for their records, safeguarding against any future questions or complications.

Ultimately, providing a formal record for a significant gift is an act of thoughtful foresight. It ensures that your generosity is not just a kind gesture but a clear, documented transfer of ownership, providing peace of mind and protection for everyone involved. Embracing a structured approach to gifting high-value items can simplify processes like registration and insurance, allowing the recipient to fully enjoy their new possession without any lingering concerns.