When you’re buying or selling a significant asset like a vehicle, boat, or even a piece of equipment, a bill of sale is your official record of the transaction. It’s a fundamental document that outlines the details of the transfer of ownership from one party to another. While a standard bill of sale works perfectly for straightforward transactions, things get a bit more complex when there’s an outstanding loan involved.

This is where understanding the specifics of a “bill of sale with lien holder template” becomes crucial. It’s not just about transferring ownership; it’s also about acknowledging and addressing the existing financial claim on the asset. Ignoring this vital step can lead to significant legal and financial headaches for both the buyer and the seller, making the correct template an absolute necessity for a smooth and legally sound transaction.Why You Need a Specific Bill of Sale When a Lien Holder is Involved

A lien is essentially a legal right or claim against an asset, held by a creditor (the lien holder) until a debt is paid. Think of it as collateral for a loan. If you’re selling a car that you still owe money on, your lender (a bank, credit union, or financial institution) holds a lien on that vehicle. This means they have a legal interest in the car until your loan is fully satisfied. Without a clear process to address this, the sale cannot truly be completed, as the new owner might inherit a claim they didn’t anticipate.

For the seller, using a document like a “bill of sale with lien holder template” provides a clear record that the buyer is aware of the outstanding lien and that provisions are being made for its satisfaction. It protects you from future claims by the buyer that they were unaware of the debt. For the buyer, it ensures that the lien will be cleared, guaranteeing clear title to the asset. Without this explicit acknowledgment and plan, the buyer could purchase an asset only to find out later that it’s still subject to seizure by the original lender if the debt isn’t paid off.

The specific bill of sale helps to orchestrate the payoff of the lien directly from the proceeds of the sale, or through other agreed-upon means. It outlines who is responsible for what, ensuring that the lien holder is paid and subsequently releases their claim on the asset. This document acts as a safeguard, ensuring that the seller’s debt is settled and the buyer receives an asset free and clear of any encumbrances, allowing for the smooth transfer of title.

Ultimately, a properly executed bill of sale with a lien holder component protects all parties involved by making the terms of the lien’s release explicit and legally binding. It’s the cornerstone of a secure transaction when an asset has an outstanding financial obligation. It eliminates ambiguity and provides a clear path to achieving a clean transfer of ownership.

Key Information to Include for Lien Resolution

- Full legal name and contact information for the lien holder.

- Exact payoff amount of the lien and the per diem interest.

- Instructions for where and how the payoff should be sent.

- A clear statement on when the lien release will be provided.

Key Elements to Look for in Your Bill of Sale with Lien Holder Template

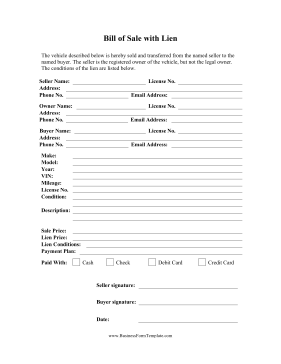

When selecting or filling out a bill of sale with lien holder template, accuracy and comprehensiveness are paramount. Start with the basics: complete identifying information for both the seller and the buyer, including full legal names, addresses, and contact details. Then, meticulously describe the item being sold. This means including make, model, year, vehicle identification number (VIN) for vehicles, serial number for equipment, or other specific identifiers that uniquely pinpoint the asset. The more detailed you are, the less room there is for disputes later on.

The most critical section, given the nature of this particular document, is the detailed information about the lien holder and the plan for satisfying the lien. This part of the template should clearly state the name of the bank or financial institution holding the lien, the account number associated with the loan, and the exact outstanding balance on the date of sale. It’s also vital to outline how the lien will be paid off. Will the buyer send the funds directly to the lien holder? Will the seller handle it immediately upon receipt of funds from the buyer? Being explicit here avoids confusion and ensures the lien is released promptly.

Beyond the lien details, a robust template will also specify the purchase price, how and when payment will be made, and the date the ownership officially transfers. It should also include an “as-is” clause, if applicable, indicating that the buyer is purchasing the item in its current condition without warranties from the seller. This protects the seller from post-sale claims about the item’s condition. Both parties should acknowledge understanding of this clause, especially when purchasing used items.

Finally, ensure the template includes spaces for the signatures of all parties involved: the seller, the buyer, and often a witness or two. Some templates might also include a section for notarization, which adds an extra layer of legal validity by verifying the identities of the signees. A properly signed and completed bill of sale, especially one that addresses a lien, is your best defense against future misunderstandings or legal challenges. It is the definitive record of the transaction and the lien’s resolution, providing peace of mind for everyone involved.

- **Identification of Parties:** Full legal names, addresses, and contact information for both buyer and seller.

- **Asset Description:** Detailed description of the item, including VIN, make, model, year, and any unique identifiers.

- **Lien Holder Details:** Name of the financial institution, loan account number, and current outstanding balance.

- **Lien Payoff Method:** Clear instructions on how the lien will be satisfied (e.g., direct payment by buyer, seller’s responsibility from sale proceeds).

- **Purchase Price & Payment Terms:** Agreed-upon price, payment method, and date of payment.

- **Date of Sale:** The exact date the ownership officially transfers.

- **As-Is Clause:** Statement regarding the item’s condition and lack of warranties, if applicable.

- **Signatures:** Spaces for buyer, seller, and witness signatures. Notary section if desired.

Choosing the right document to finalize a sale, especially one involving a lien, is not a step to be overlooked. It’s the legal backbone of your transaction, ensuring clarity, protecting your interests, and preventing future complications. By utilizing a document specifically designed for these circumstances, you ensure that the transfer of ownership is not just complete, but legally sound, leaving no room for ambiguity regarding outstanding financial obligations.

Taking the time to properly fill out and understand every section of your chosen template will save you immense hassle and potential legal fees down the road. It provides a comprehensive record for both parties and for any future dealings concerning the asset’s title, confirming that all debts are cleared and the new owner has full, unencumbered rights to their purchase.