Selling a business, whether it’s a cozy coffee shop, a bustling online store, or a long-standing consultancy, is a significant milestone. It involves a lot more than just handing over keys or website login details. There are assets, liabilities, customer lists, intellectual property, and often, goodwill that needs to be properly transferred. Getting this transition right is not just good practice; it’s essential for both the buyer and the seller to protect their interests and ensure a smooth, legally sound transaction.

Among the various legal documents you’ll encounter during a business sale, one stands out as absolutely critical: the bill of sale. Think of it as the ultimate receipt for your business. It legally confirms the transfer of ownership of specified assets from the seller to the buyer. Using a comprehensive bill of sale for business template can provide a robust framework, helping you navigate this complex process with greater confidence and clarity, ensuring all the necessary details are meticulously recorded.

Why You Absolutely Need a Bill of Sale When Selling or Buying a Business

When you’re dealing with the transfer of an entire business, a simple handshake just won’t cut it. A bill of sale serves as the definitive legal document that proves ownership of the business assets has officially changed hands. It’s the moment the buyer truly takes possession and the seller relinquishes all rights and responsibilities. Without this document, disputes over what was sold, for how much, and under what conditions can easily arise, leading to costly legal battles and immense frustration for everyone involved.

This crucial document acts as a shield for both parties. For the buyer, it provides undeniable proof that they are now the rightful owner of the specified assets, protecting them from any future claims by the previous owner or other third parties. For the seller, it clearly marks the end of their ownership, freeing them from future liabilities or obligations associated with the business, provided the terms are followed. It’s about creating a clear cut-off point and establishing legal certainty for the transaction.

Beyond merely proving ownership, a well-drafted bill of sale helps to prevent misunderstandings and potential disagreements down the line. It explicitly details what is included in the sale and, just as importantly, what is not. This can cover everything from physical equipment and inventory to intangible assets like client lists, intellectual property, and even the business’s name itself. Spelling out these specifics eliminates ambiguity, which is a common source of post-sale disputes.

Moreover, in many jurisdictions, a bill of sale is required for proper record-keeping and sometimes for tax purposes. It ensures that the transfer is recognized by relevant authorities, which can be vital for permits, licenses, and other regulatory compliance necessary for the continued operation of the business under new ownership.

Key Elements to Include in Your Business Bill of Sale

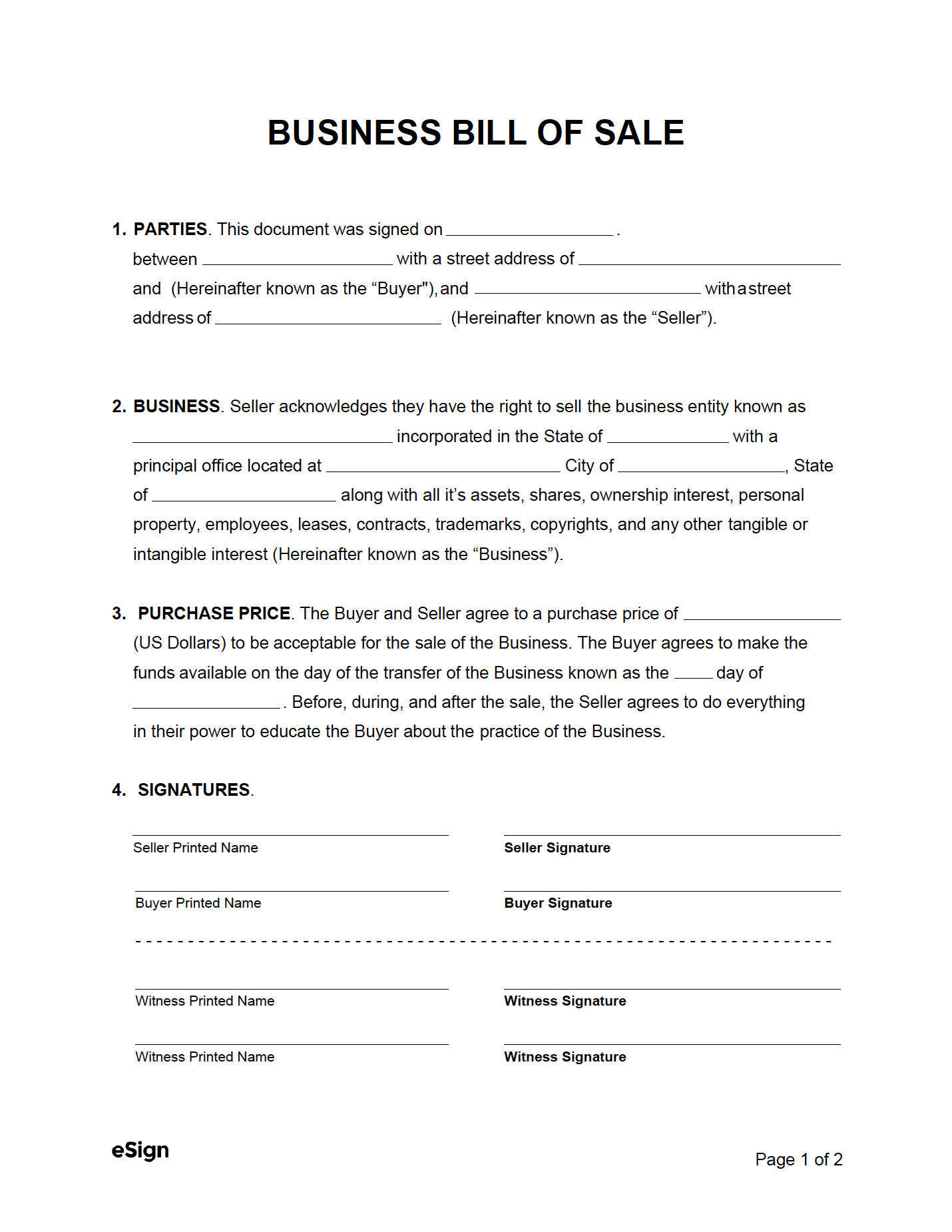

To be effective, a bill of sale for business template should include several critical pieces of information. These elements ensure that the document is legally sound and comprehensive, leaving no room for doubt about the terms of the sale.

- Identification of Parties: Clearly state the full legal names and addresses of both the seller and the buyer. If either is a corporation or LLC, include their official registered name and address.

- Detailed Business Description: Specify the full legal name of the business being sold, its primary location, and a clear description of its nature and operations.

- Description of Assets Being Transferred: This is crucial. List all tangible assets (equipment, inventory, furniture, vehicles, real estate if applicable) and intangible assets (trademarks, copyrights, domain names, customer lists, goodwill). Be as specific as possible.

- Purchase Price and Payment Terms: Clearly state the total purchase price for the business and how it will be paid (e.g., lump sum, installments, financing details).

- Representations and Warranties: These are statements by the seller about the condition of the assets and the business, assuring the buyer that certain facts are true (e.g., assets are free of liens, business is in good standing).

- Governing Law: Specify which state’s or country’s laws will govern the agreement, which is important for any future legal interpretations.

- Signatures and Dates: The document must be signed and dated by both the seller and the buyer, and often requires witness signatures or notarization to be fully legally binding.

Navigating Your Business Sale with a Reliable Template

Using a well-structured bill of sale for business template offers a significant advantage in what can be an overwhelming process. It provides a solid foundation, ensuring that you don’t overlook essential clauses or information that could prove problematic later. Instead of starting from scratch, which can be time-consuming and prone to errors, a template gives you a professional, pre-formatted document that covers the standard legal requirements for a business asset transfer.

The beauty of a template lies in its adaptability. While it offers a comprehensive structure, it’s designed to be customized to fit the unique specifics of your business transaction. Every business sale is different, with varying assets, payment structures, and specific terms. You’ll need to carefully review the template and fill in all the blanks with accurate details relevant to your particular agreement, ensuring that it truly reflects the nuances of your deal.

However, it’s vital to remember that a template is a starting point, not a substitute for professional legal advice. While a good bill of sale for business template covers common scenarios, complex business sales often involve unique circumstances that require specific legal wording or additional clauses. Consulting with a legal professional, even when using a template, is highly recommended to ensure the document fully protects your interests and complies with all applicable laws in your jurisdiction.

When utilizing a template, pay close attention to the descriptions of assets and any liabilities being transferred. Precision here is paramount to avoid future disputes. Double-check all financial details, payment schedules, and any conditions precedent to the sale. Clear communication and meticulous detail in the document will serve both parties well, fostering trust and ensuring a smooth transition of ownership.

Completing a business transaction successfully hinges on meticulous planning and thorough documentation. The bill of sale acts as the cornerstone of this process, providing a clear and legally binding record of the transfer of ownership. It is the definitive proof that all specified assets and associated responsibilities have moved from one party to another, securing the interests of both the seller and the buyer.

By leveraging a comprehensive template as your foundation and carefully tailoring it to your specific deal, you equip yourself with a powerful tool for a secure transfer. This diligent approach ensures that your business transition is not only successful but also legally robust, providing peace of mind for everyone involved as they embark on their next ventures.