In the bustling world of business, clarity and mutual understanding are not just courtesies; they are cornerstones of successful operations. Every time you send out a bill or an invoice, you are essentially initiating or concluding a transaction. While the main body of the bill outlines the services rendered and the amount due, it is often the accompanying terms and conditions that truly define the parameters of the agreement, protecting both the service provider and the client. Having a well-crafted, clear set of terms can prevent misunderstandings, disputes, and ensure a smooth payment process.

Navigating the legal intricacies of invoicing can seem daunting, especially for small businesses or freelancers who might not have dedicated legal departments. This is where a robust bill terms and conditions template becomes an indispensable asset. It provides a standardized framework, ensuring that all necessary clauses are included, from payment deadlines to dispute resolution methods, thereby safeguarding your interests and providing clear expectations for your clients. It removes ambiguity and sets a professional tone for your business relationships.

What Exactly Goes Into a Robust Bill Terms and Conditions Template?

When you sit down to draft or adapt a bill terms and conditions template, it is important to think about all the potential scenarios that might arise during a business transaction. These terms are not just about getting paid; they are about defining the entire commercial relationship surrounding that invoice. They serve as a legal guide for both parties, clarifying responsibilities and expectations long before any issues might surface. A well-constructed template acts as a proactive measure, saving time and resources that might otherwise be spent resolving disputes.

Beyond simply stating “payment due in 30 days,” a comprehensive template delves deeper. It considers what happens if payment is late, how disagreements are handled, and what level of service is guaranteed. This level of detail provides a strong foundation for your financial interactions. It also demonstrates professionalism, showing clients that you operate with clear boundaries and a structured approach to your business dealings. Therefore, understanding the essential components is key to creating an effective document that truly protects your interests.

The core elements of a valuable template typically cover several critical areas, each designed to ensure a smooth transaction and provide recourse if things go awry. These aren’t just legalistic phrases; they are practical clauses that manage expectations and mitigate risks. Ignoring any of these could leave your business vulnerable to unforeseen complications down the line. It’s about establishing transparent rules of engagement for every bill you issue.

Consider including the following essential clauses in your bill terms and conditions template:

-

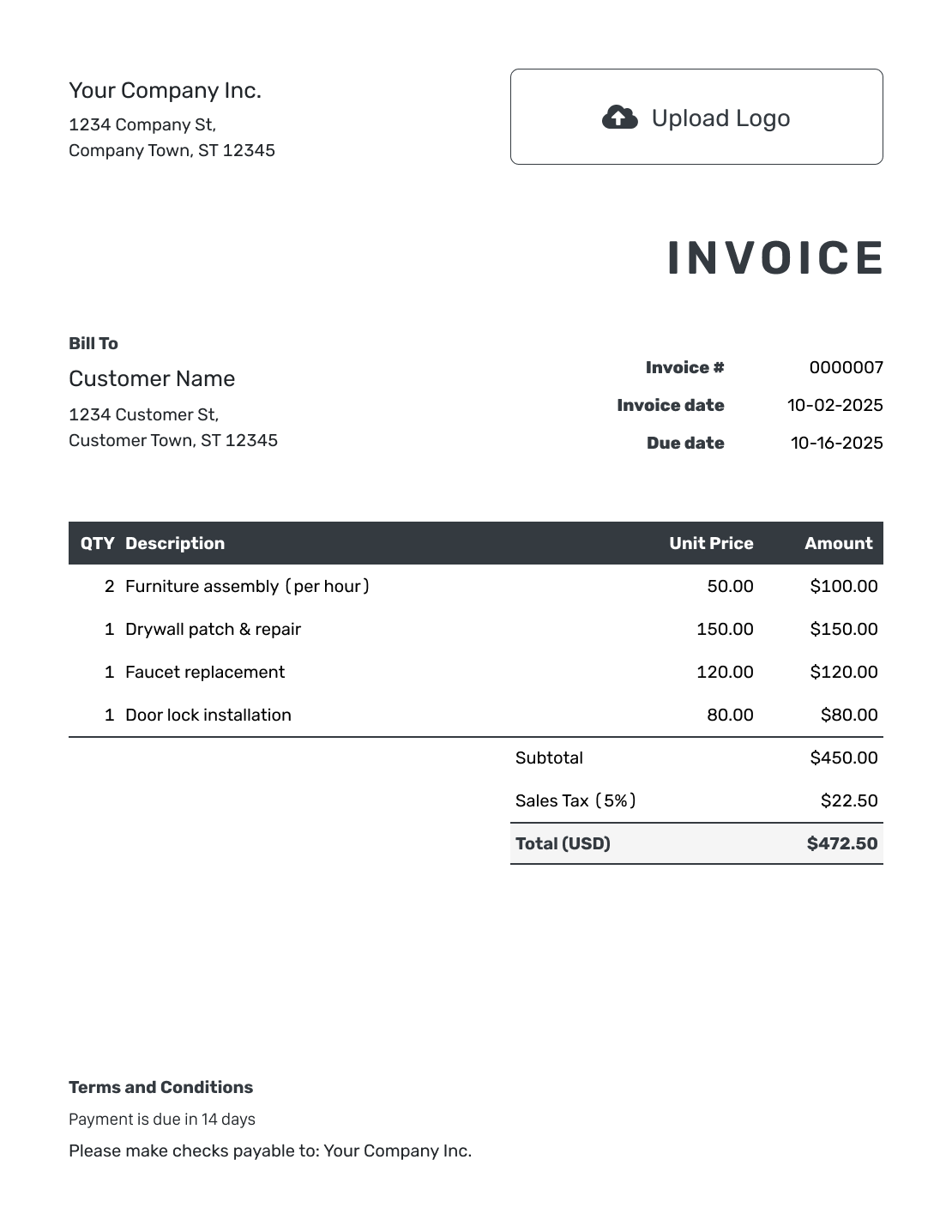

Payment Terms and Due Dates

This section clearly specifies the payment deadline, whether it is 15, 30, or 60 days from the invoice date, or if it is due upon receipt. It also outlines accepted payment methods and currencies, ensuring there’s no confusion about how and when you expect to be paid.

-

Late Payment Penalties

To encourage timely payments, this clause details any interest charges, late fees, or other penalties that will be applied if the invoice is not paid by the due date. This incentivizes promptness and compensates you for the inconvenience and cost of delayed revenue.

-

Dispute Resolution Process

Outline the steps clients should take if they have a query or dispute regarding the invoice or services. This could involve an initial communication, a formal review process, or even mediation or arbitration, providing a clear path to resolve disagreements professionally.

-

Refund and Cancellation Policies

If applicable to your services or products, specify the conditions under which refunds are issued or cancellations are accepted. This manages client expectations regarding returns or service termination and helps avoid misunderstandings after a transaction is complete.

-

Confidentiality and Data Protection

State how client data will be handled, ensuring compliance with privacy regulations like GDPR or CCPA if relevant. This builds trust by demonstrating your commitment to protecting sensitive information and outlines any confidentiality agreements.

Crafting Your Template and Ensuring Legal Compliance

While a general bill terms and conditions template provides a fantastic starting point, the real strength lies in its ability to be tailored to your specific business, industry, and local regulations. A generic template might cover the basics, but it won’t necessarily address the unique nuances of your services, the particular risks associated with your niche, or the specific laws governing your operations. Therefore, customization isn’t just a suggestion; it is a necessity to ensure your terms are truly effective and legally sound for your particular circumstances.

Think about the nature of your business: Are you selling digital products, providing consulting services, or dealing with physical goods? Each has different considerations for delivery, returns, intellectual property, and liability. A template for a freelance graphic designer will look different from one for a construction company, even if some core clauses overlap. Taking the time to personalize your terms reflects a deep understanding of your own business model and its potential challenges, offering more robust protection.

Moreover, keeping up with legal compliance is paramount. Laws related to consumer rights, data privacy, payment processing, and even advertising can change, impacting how you should structure your terms. What was compliant last year might not be today, so a regular review of your bill terms and conditions is a wise practice. Consulting with a legal professional who understands your industry and local jurisdiction can provide invaluable insight and ensure your template holds up under scrutiny, protecting you from potential legal headaches.

When customizing, ensure clarity above all else. Avoid overly complex legal jargon that can confuse clients. Your terms should be easy to understand, even for someone without a legal background. Use clear, concise language and unambiguous statements. This not only makes your terms more accessible but also ensures that both parties clearly understand their obligations and rights, fostering better relationships and minimizing disputes down the line.

A thoughtfully developed set of terms and conditions on your bills does more than just specify payment details; it acts as a comprehensive framework for your professional relationships. It establishes clear boundaries, manages expectations, and provides a reliable reference point should any questions or disagreements arise. By detailing everything from payment schedules to dispute resolution, you empower your clients with transparency and safeguard your business against potential pitfalls.

Investing time in creating or adapting a robust template for your invoicing practices is a strategic move that pays dividends in operational efficiency and risk mitigation. It ensures that every transaction is underpinned by a clear understanding, fostering trust and enabling smoother financial interactions. Ultimately, well-defined terms contribute significantly to the long-term health and stability of your business, allowing you to focus on growth with greater peace of mind.