Ever found yourself wanting to pass on a cherished item, like a family car or a valuable antique, to a loved one without exchanging money? It feels like a simple act of generosity, doesn’t it? While the sentiment is beautiful, it’s often wise to have a formal record, even for gifts. Think of a bill of sale as a simple document that proves ownership has changed hands, providing clarity and protection for everyone involved.

When an item is given as a gift, especially something of significant value, a standard bill of sale might not quite fit. This is where a specialized gifted bill of sale template comes into play. It helps formalize the transfer of ownership without implying a sale, ensuring that both the giver and the recipient have a clear record for future reference, whether for registration, insurance, or simply peace of mind.

Why a Gifted Bill of Sale is More Than Just a Nice Gesture

You might wonder why you’d need a formal document for something you’re just giving away. After all, it’s a gift! But consider the practicalities. For instance, if you’re gifting a vehicle, the new owner will need proof of ownership to register it with the Department of Motor Vehicles. A simple signed note might not be enough, but a properly structured gifted bill of sale template provides all the necessary details, confirming that the transfer was indeed a gift and not a traditional sale.

Beyond vehicle registration, there are other crucial reasons. Taxes, for one, can be a complex area. While many gifts fall under annual exclusion limits, some larger gifts might have reporting requirements. Having a clear document stating the item was gifted and its approximate value can be invaluable for tax purposes for both parties, helping to avoid any misunderstandings with tax authorities down the line. It serves as a definitive record of the transaction’s true nature.

Then there’s the matter of liability. Imagine you gift a used boat to a friend, and later, an unforeseen issue arises with the vessel. A gifted bill of sale clearly marks the exact date and time of the ownership transfer, effectively shifting responsibility from the giver to the recipient. This clear delineation can prevent future disputes or misunderstandings, protecting both parties from unforeseen complications.

Ultimately, using a document like this brings a layer of professionalism and clarity to what might otherwise be an informal transaction. It provides a legal record that the item was transferred freely, without financial exchange, reducing the potential for disputes or confusion about ownership later on. It’s about protecting relationships and ensuring smooth transitions.Common Situations Where a Gifted Bill of Sale is Useful

- Gifting a car, motorcycle, or other vehicle to a family member or friend.

- Transferring ownership of a valuable pet, ensuring the new owner has proof for vet records or local registrations.

- Passing down expensive equipment, like heavy machinery or specialized tools.

- Donating a valuable item to a charity or non-profit organization, which often requires a clear record for their accounting and your tax deductions.

- Transferring ownership of significant personal property like artwork, jewelry, or collector’s items.

Essential Components of Your Gifted Bill of Sale Template

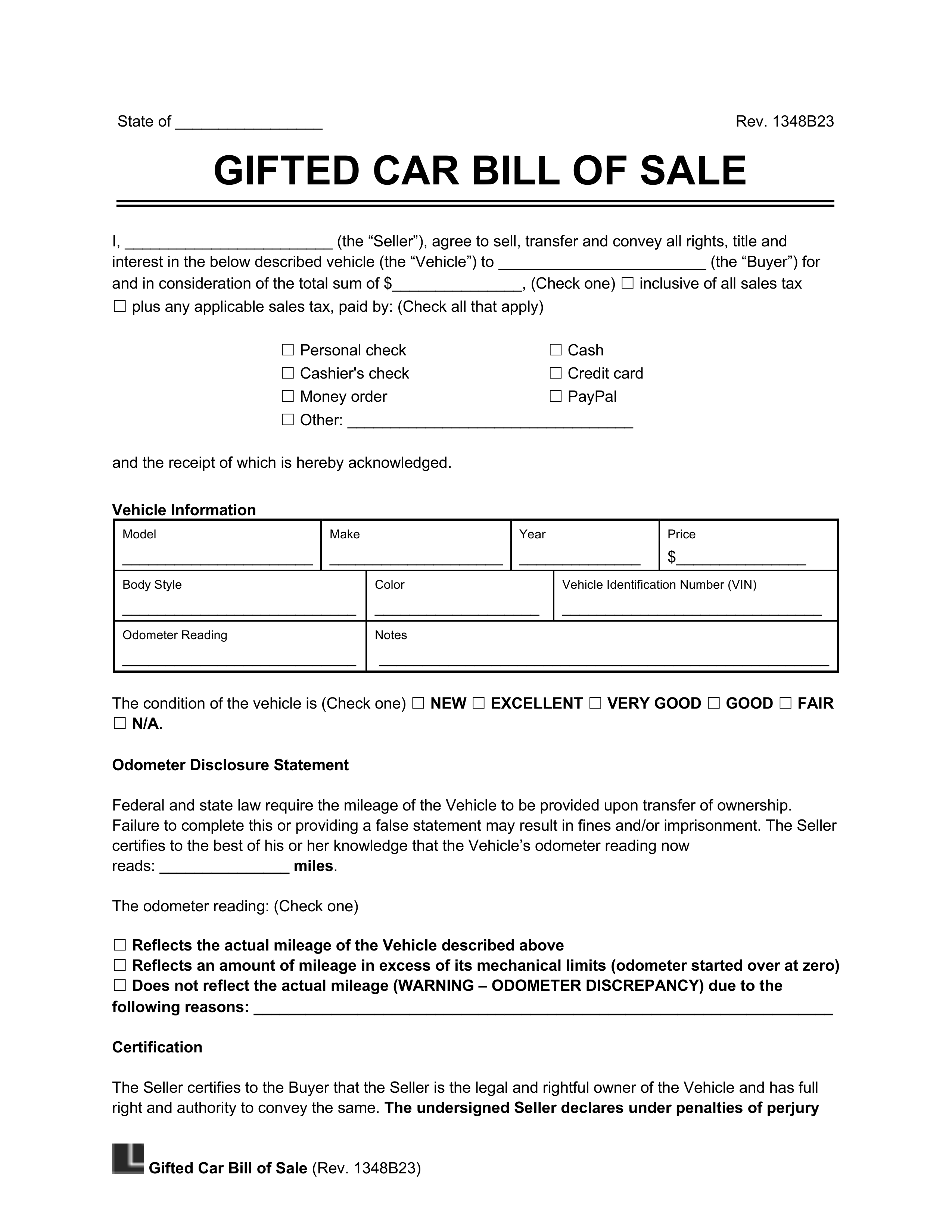

Crafting an effective gifted bill of sale doesn’t have to be complicated, but it does require including some specific details to ensure its validity and usefulness. First and foremost, the document needs to clearly identify both the giver (often called the “grantor” or “donor”) and the recipient (the “grantee” or “donee”). This means including their full legal names and current addresses. Accuracy here is key, as these details tie the document directly to the individuals involved.

Next, a comprehensive description of the gifted item is absolutely crucial. This isn’t just about saying “my old car.” You’ll want to include specifics like the make, model, year, color, and, most importantly, any unique identifiers like a Vehicle Identification Number (VIN) for cars, a serial number for electronics, or a detailed description for artwork or jewelry. The more specific you are, the less room there is for misinterpretation or confusion about exactly what item was gifted.

The most distinctive element of a gifted bill of sale, differentiating it from a standard sales agreement, is the explicit declaration that the item is being given as a gift. This means stating clearly that “no monetary consideration or other form of payment was exchanged for this item.” This clause is vital for tax purposes and to prevent any future claims of purchase or debt related to the item. It solidifies the intent of the transfer as a true gift.

Finally, no bill of sale is complete without the date of the transfer and the signatures of both the giver and the recipient. The date establishes precisely when ownership changed hands, which can be critical for registration or liability purposes. Signatures confirm that both parties agree to the terms of the transfer. While not always legally required, having one or two impartial witnesses sign the document can add an extra layer of authenticity and legal strength, especially for high-value items.

Having a well-prepared document, even for something as simple as giving a gift, can make a world of difference. It transforms a kind gesture into a clear, legally sound transaction, providing both the giver and the recipient with essential records. This proactive step helps prevent potential headaches down the line, whether they relate to vehicle registration, tax filings, or simply proving ownership.

Utilizing a comprehensive gifted bill of sale template ensures that all necessary information is captured accurately, offering peace of mind and clarity for all parties involved. It’s an easy yet impactful way to formalize your generosity, making sure your gift brings joy without any lingering questions or complications.