Buying or selling a vehicle can be an exciting time, whether you are upgrading to a new model or finding a new home for your trusty car. However, amidst the excitement, it is crucial not to overlook the essential paperwork that makes the transaction legal and smooth. A properly executed bill of sale is not just a formality; it is a vital document that protects both the buyer and the seller from potential disputes down the road.

Specifically in Illinois, understanding the nuances of vehicle transactions requires attention to detail. This document serves as a legally binding record of the transfer of ownership, detailing everything from the vehicle’s specifics to the terms of the sale. Having a reliable format for this crucial paperwork can save you a lot of hassle and provide peace of mind during what should be a straightforward process.

Understanding Your Vehicle Bill of Sale in Illinois

A vehicle bill of sale is essentially a receipt for a car purchase or sale. In Illinois, it acts as a legal document that formally records the transfer of ownership of a vehicle from one party to another. It provides crucial proof of the transaction, detailing the buyer, seller, vehicle specifics, and the agreed-upon price. This document is not only important for personal record-keeping but is often required by the Illinois Secretary of State (SOS) when the buyer registers the vehicle and applies for a new title. Without it, verifying the sale can become complicated, potentially delaying the entire process.

The bill of sale protects both parties involved. For the seller, it provides documented proof that they no longer own the vehicle as of a specific date, which is crucial for liability purposes if the vehicle is involved in an accident or receives tickets after the sale. For the buyer, it establishes legal ownership and confirms the terms of the purchase, which is vital for title transfer, registration, and tax assessment. It also serves as evidence if there are any discrepancies or disputes regarding the vehicle’s condition or agreed price after the transaction.

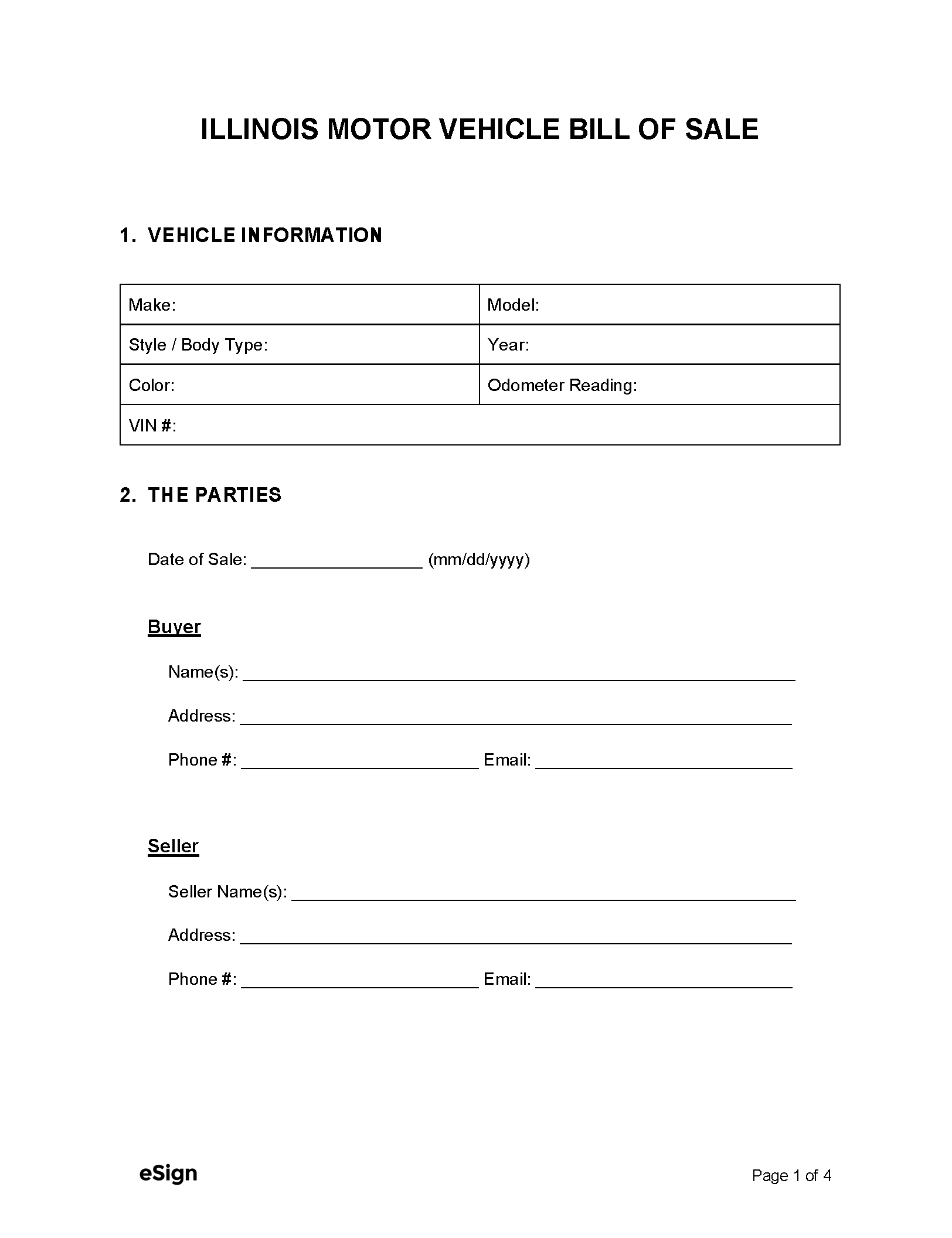

Creating a comprehensive and legally sound bill of sale can seem daunting if you are starting from scratch. This is where a well-structured vehicle bill of sale Illinois template becomes incredibly valuable. It ensures that all necessary information is included, leaving no room for errors or omissions that could cause problems later on. Using a template helps standardize the process, making it easy to fill out and ensuring compliance with state requirements. It acts as a checklist, guiding you through each piece of information required for a valid transfer.

From the vehicle’s identification details to the agreed-upon sale price and any special conditions, a template ensures every critical element is covered. It helps prevent misunderstandings between the buyer and seller by clearly outlining the terms of the agreement. This systematic approach ensures that both parties have a clear, undeniable record of the transaction, simplifying the post-sale procedures and securing the legality of the transfer.

Essential Elements of an Illinois Vehicle Bill of Sale

- Vehicle Identification Number (VIN) and current odometer reading

- Complete make, model, year, and body style of the vehicle

- Full legal names, addresses, and contact information for both the seller and the buyer

- The agreed-upon purchase price of the vehicle, clearly stated in numerical and written form

- The exact date of the sale and location where the transaction occurred

- Signatures of both the seller and the buyer, acknowledging their agreement to the terms

- An “as-is” clause, if applicable, indicating the buyer accepts the vehicle in its current condition

- Any specific warranties or conditions agreed upon by both parties

Navigating the Post-Sale Paperwork in Illinois

Once your vehicle bill of sale Illinois template has been thoroughly completed and signed by both parties, the transaction is officially documented. However, the process does not end there. For the buyer, the bill of sale is a critical piece of the puzzle for applying for a new title and registration with the Illinois Secretary of State. This step is mandatory to legally operate the vehicle in Illinois and to prove definitive ownership. The SOS will use the information on the bill of sale, along with the existing vehicle title, to process the transfer and calculate applicable sales taxes.

Buyers will typically need to present the bill of sale, the original vehicle title (signed over by the seller), and proof of Illinois liability insurance to their local SOS facility. They will also be responsible for paying sales tax, title transfer fees, and registration fees. The bill of sale clarifies the purchase price, which is essential for accurate sales tax calculation. Without a clear and complete bill of sale, the SOS may question the transaction details, leading to delays or requests for further documentation.

For sellers, their responsibilities extend beyond simply handing over the keys. Once the vehicle is sold, it is imperative to remove the license plates from the vehicle. Illinois law requires license plates to stay with the seller, not the vehicle. These plates can often be transferred to another vehicle the seller owns or surrendering them to the SOS if no transfer is intended. It is also advisable for sellers to notify the Illinois Secretary of State of the sale. This action helps to officially release the seller from any future liability associated with the vehicle.

Failing to properly complete these post-sale steps can lead to unnecessary complications. For instance, if the buyer does not register the vehicle promptly, the seller could still be held liable for parking tickets or even accidents if the vehicle is still associated with their name. Similarly, buyers who delay registration risk penalties and operating an untaxed and unregistered vehicle. A properly completed bill of sale, alongside a clear understanding of the subsequent steps, ensures a smooth transition for both parties.

Ensuring every detail is correctly noted and following up with the necessary state procedures will safeguard both your financial interests and your legal standing. Taking the time to properly document the sale and complete the subsequent paperwork provides invaluable peace of mind. It allows both parties to move forward, knowing the vehicle transfer was conducted professionally and legally according to Illinois state guidelines.