When you are buying or selling a car in the Bay State, one document stands out as absolutely essential for a smooth and legal transaction: the bill of sale. This seemingly simple piece of paper is far more than just a receipt; it’s a legally binding agreement that protects both the buyer and the seller, establishing the terms of the sale and providing crucial information for registration and title transfer with the Massachusetts Registry of Motor Vehicles, or RMV. Without it, you could face delays, legal complications, or even disputes down the road.

Understanding what makes a bill of sale valid and comprehensive for Massachusetts standards is key. While there isn’t one official form specifically dubbed the “bill of sale for car massachusetts rmv template” provided directly by the state, adhering to a clear, detailed template ensures you include all the necessary information that the RMV will require and that will safeguard your interests. This document acts as your official record of ownership transfer and is a foundational piece for handling all the subsequent paperwork.

Why You Absolutely Need a Bill of Sale in Massachusetts

Think of the bill of sale as the official handshake, but in written form, documenting the transfer of ownership of a vehicle. For the seller, it provides proof that the car is no longer their responsibility, protecting them from any future liability related to the vehicle, such as accidents or parking tickets incurred after the sale. It also clearly states the date and time of the sale, which is vital for ending your insurance coverage on that specific vehicle.

For the buyer, this document is undeniable proof of purchase and a critical step towards legally owning the car. It validates the purchase price, which is essential for calculating sales tax owed to the state. More importantly, it is a non-negotiable requirement when you go to register the vehicle and apply for a new title at the Massachusetts RMV. Without a properly executed bill of sale, the RMV simply won’t process your application, leaving you unable to legally drive your new car.

Moreover, a well-drafted bill of sale can outline the condition of the vehicle at the time of sale, often stating whether it’s being sold “as-is” or with any specific warranties. This can prevent misunderstandings or disputes should issues arise after the transaction is complete. It also confirms that the seller had the legal right to sell the vehicle, protecting the buyer from potential claims of theft or unauthorized sale.

Ensuring your bill of sale contains all the necessary details is paramount for its legal validity and acceptance by the RMV. While you might not find a direct bill of sale for car massachusetts rmv template online, creating your own based on what’s required is straightforward.

Key Information to Include in Your Bill of Sale

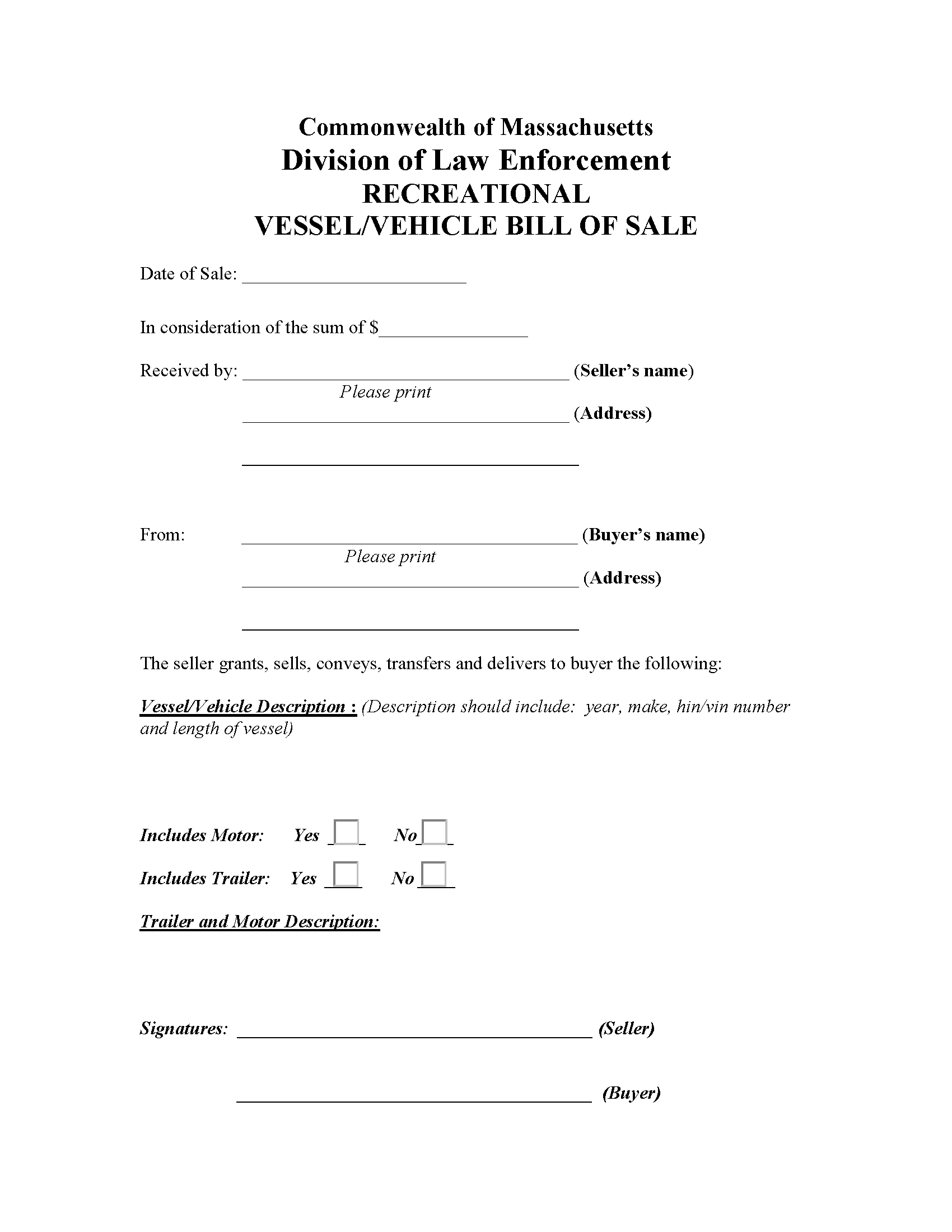

- Date of Sale: The exact day, month, and year the transaction took place.

- Buyer’s Full Legal Name and Address: Including their driver’s license number for identification.

- Seller’s Full Legal Name and Address: Including their driver’s license number.

- Vehicle Description: Make, model, year, body style, and color.

- Vehicle Identification Number (VIN): This is crucial and must match the vehicle and title exactly.

- Odometer Reading: Stated at the time of sale, indicating whether the reading is actual, not actual, or exceeds mechanical limits.

- Purchase Price: The agreed-upon selling price of the vehicle, both in numerical and written form.

- Method of Payment: How the payment was made (e.g., cash, check, bank transfer).

- Condition of Sale: Whether the vehicle is sold “as-is” with no warranties, or if any specific warranties apply.

- Signatures: Both the buyer and seller must sign and print their names.

- Witness Signatures: While not always legally required, having witnesses sign can add an extra layer of security.

Navigating the Massachusetts RMV with Your Bill of Sale

Once you have your completed bill of sale, along with the properly assigned vehicle title, proof of Massachusetts auto insurance, and the Registration and Title Application (Form RMV-1), you are ready to visit a Massachusetts RMV service center. The bill of sale is scrutinized by the RMV to confirm the details of the transaction, especially the purchase price, which directly impacts the sales tax you will owe. In Massachusetts, vehicles are subject to a 6.25% sales tax on the purchase price, or the National Automobile Dealers Association (NADA) book value, whichever is greater, unless specifically exempted.

Presenting a clear, legible, and complete bill of sale will significantly expedite your visit to the RMV. Any missing information, discrepancies, or illegible handwriting could lead to delays, requiring you to return with corrections. It is always a good idea to bring extra copies of all your documents, including your bill of sale, just in case. They will keep one original for their records, and you should retain one for your own files.

Remember that the bill of sale for car massachusetts rmv template you use should be comprehensive enough to capture all these details accurately. The RMV staff rely on this document to verify that the sale was legitimate and that all necessary information is available for processing your new registration and title. Be prepared to fill out other forms at the RMV, but the bill of sale remains a cornerstone of the transfer process.

After you have successfully registered your vehicle and obtained your new title and license plates, remember to store all your original transaction documents in a safe place. These include your bill of sale, the old title, your new title and registration, and any receipts for sales tax or fees paid. Having these readily accessible can be crucial for future reference, insurance claims, or if you ever decide to sell the vehicle yourself. It also serves as your complete record of ownership from the moment you acquired the car.